|

1.

Wellbeing

Government Spending

Income Inequality

Stagnate

Wages

1 .

Government Spending

Helps Many

2. Causes Inflation in

Health Care and Education

|

|

3. Resulting in Deficits

4.

Enhamced by Tax

Cheats

|

|

Wellbeing:

Income Inequality

When Will

Income Inequality Affects

Growth

x-sizing: border-box; box-sizing: border-box">

Blame

Democracy,

Not Capitalism,

for Income Inequality

|

4 G's Are The Problem

Today, the four G’s of Guns, God,

Greed and Government backing of a free market

philosophy

have created a diverse group who want less government.

Greed has created much income and wealth, but most

income has floated to the top. Much poor people wealth is tied up in

inaccessible SS and Medicare. This accumulation is not included

in traditional wealth calculations. It earns a higher return for the

poor, who get a real good deal, provided they live long enough to

collect benefits.

|

|

The Guns and God group

want limited government

which allows their simplistic lifestyle.

|

US

wealthy coastal

states have continued their efforts to help

poorer rural states by

agreeing to pay for much of Obamacare. They also wanted to increased Medicaid benefits and to increase many other

safety net programs.

"Huston

we have a problem." U.S.

rural mostly

southern states do not want help. They

feel government interferes too much into their lives, federal programs

are too expensive and payments go to undeserving people. So they lobby

for lower taxes meaning less money to Washington.

A Tale of Two Talesf

|

Government,

helped by the

neoliberals like Greenspan,

want less regulation associated with anything business

to increase their share of the pie. They would keep military and

elderly spending high with no increases for anything else.

These for G's divided our country before it was a country. |

|

|

Our

Democratic Federalist Capitalistic Republic

is responsible for the design,

implementation and success of programs to help solve society's problems.

We will eventually succeed. but with some consternation.

People wanting income differently

distributed should vote

accordingly

but

many voters feel they have at least one more important need which they support with

Political Action Committees. |

Guns

are protected by the NRA.

God

is protected by

relegiouse

rights groups.

Greed

is

protected by

the Chamber of Commerce,

AARP and other

Super PACs.

Government

is protected unionized employees,

politicians and economists wanting to enhance their

career possibilities.

See

Public Policy Affects Income Inequality |

|

|

|

2.

Measuring Activity

Inflation

Employment

Uncertainty of Capitalism

Inflation

The

Value of Money

Are

Wages

Stagnate A

Politician's Dream!

Which

Data

Set Will Get the Most Votes?

|

|

More Earned

Higher Incomes

Fewer Earned

Low Income

|

|

Will

Inflation Come Back

People

are Currently Nervous

Much

Worse 1970-1985

History

Says Yes

Leaving Gold Standard Changed Variability of Money's

Value

|

|

|

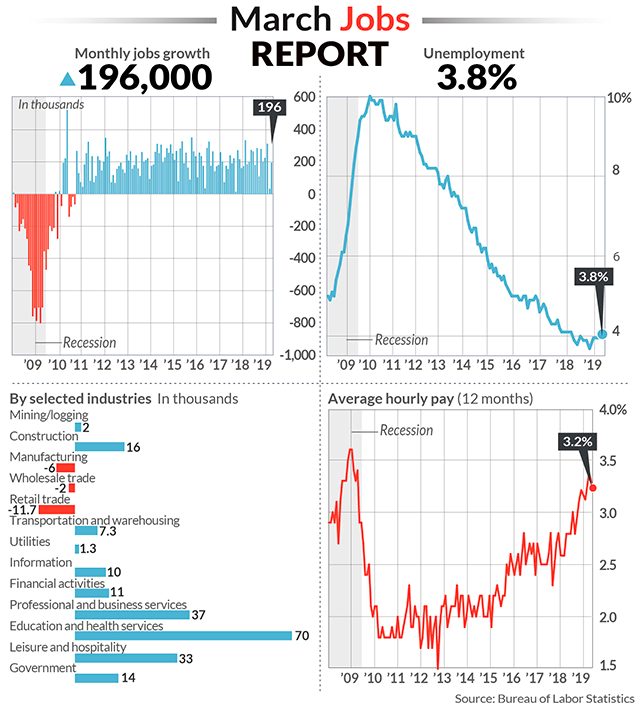

3. Macro:

Lately Unemployment

Down, Wages Up

Increasing Minimum Wages Means

Temporary Job Loses |

|

|

|

Source:

Canary in the coal mine? NYC small businesses struggle to survive $15 minimum wage hike: ‘They’re shutting down’

|

|

|

More and More Diversified Employment

visualcapitalist |

|

Uncertainty

of Capitalism

|

|

3.

Macro

GDP

Usefulness Distributing

GDP Growing

GDP

Management

GDP Usefulness

How

US Uses GDP

|

|

Macro: Distributing GDP

Consumption Gets Most, Gov Gets More.

Investment Down Lately

Net Exports Negative as Foreigners sell Good Stuf Cheap

|

|

|

|

Growing GDP

Did Fiscal

Stimulus Packages Help

The Answer is Yes

thedailyshot.com/2020/11/30/us-consumer-spending-remained-resilient-this-month/ |

|

Macro Management

Post WW 2 U.S.

Micro Competitive Adjustments

|

|

U.S. Economic Normality

1945 -2015

Bailouts

Safety Net

Profits vs. Labor

Wellbeing

page 2

|

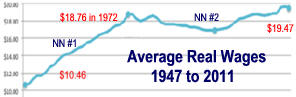

New Normal

#1 Rising Income

WW 2 generated savings, pent-up demand and few foreign few competitors

generated 25 years of high

profits higher wages and cooperative unions.

|

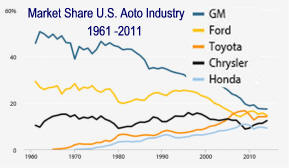

New Normal #2 Oil Embargos and Competition

Began Wage Stagnation

Japan's competitive manufacturing sector

accelerated causing stagnate Rust Belt wages and employment. Why? Japan

got lucky when gas efficient small green cars required change and U.S.

manufacturing responded by protected profits with less quality improving

capital investment. Unions protected current workers by accepting

a

two-tier wage system minimizing new worker wages. Feeling

pressure Japan built modern U.S. plants.

See

How the U.S. Squandered Its Steel Superiority and

The End of the International Liberal Order?

1hr: 28 min |

|

|

New Normal #3 Financial Instability from

Philosophical Change

1980's U.S. and England Returned to Conservative Lax Business Regulation

because increased regulation and increased welfare provisions had upset many voters.

Think Great Society and lax derivative regulation.

1980's Major Investments Banks Went Public

creating a need to balance client needs with equity needs.

Think expansion of financial industry's share of GDP.

1980's Accounting Standards Declined

as accountancy firms struggled to balance commitments to audit

standards with the desire to grow their consultancy business.

Think

off-balance-sheet items and

Arthur Anderson Scandal.

1980's

Home Equity Loans

Increased Current Consumption and Lowered Savings as they replaced

equity building home improvement loans.

Think many not prepared for retirement.

|

1983 Reverse Mortgages Approved for FHA loans.

Think less retirement savings.

1999 Gramm–Leach–Bliley Act Increased Systemic Financial Risk

once limited by the Glass-Steagall Great Depression Act. Initiated by

Republicans it was signed by President Clinton.

Think financial industry expansion. See

Five Bad Bush/Clinton Policies

2004 Uptick Short Rule of 1938 rescinded. Think

stock market gambling.

2006 FASB requirement that housing assets be mark-to-market decreased

financial system collateral.

Action resulted from a 1991 Government Accountability Office investigation

of the $160,000,000,000

savings

and loan bailout.

Think moral hazard.

|

|

From

Financial Crisis to

Recession

to

Great Recession to Recovery

1. 2007-8 Financial Crisis was tamed by the Federal Reserve.

2. 2008-9 Recession was tamed by monetary and fiscal policy.

3. European financial instability and world-wide austerity slowed economic recovery

and income growth

for all but the very, very, very wealthy. Think top 1/10th of one-percent.

4.

Great Recession Recovery Has Varied Around the World |

|

Understanding Balance Sheet Recessions

They are

infrequent, severe, and long-lasting. Understanding them is necessary when

judging society's efforts to manage The Great Recession. It is like understanding a doctor's attempt

to relieve a headache requires knowing the level of difficulty. Was it a

Migraine Headache? A balance sheet is

caused by high levels of private sector

debt. Assets must equal liabilities plus

equity. If assets values like housing collateral fall below their

associated debt, equity must make up the difference or insolvency results

and debt must be repaid. Think 1837, 1873, 1890 & 1929 See

Most Severe US Recessions.

Was Our Great Recession a Balance

Sheet Recession?

Economist

Paul Krugman feels the

financial crisis ..."was one manifestation of a

broader problem... associated with a "balance sheet recession."

Economist Richard Koo wrote Japan's 1990- ?

"Great Recession "was a "balance

sheet recession." |

What Led To The

Great Recession?

1. Free Market Capitalism Lowered Regulation.

2.

Innovative Expanded Investment Banking.

3. Global Trade Imbalances

|

|

China 2012

Germany 2012

Saudi

Arabia 2009

Japan 2011

Russia 2012

4. Finance/Housing

Easy Money Bubbles |

$214B

208B

150B

119B

81B

|

Great Recession Stages

from

The Shifts and the Shocks by Martin Wolf

1. A more complex unstable financial/credits system

resulted in extreme optimism in

good times and panic in bad times.

Think derivatives, securitization,

credit default swaps all

managed by hedge funds.

2. Savings glut created

as

emerging countries lowered borrowing and increased trade surpluses

after

the 1997

Asian Debt Crisis

made their foreign dollar dominate debt unsustainable. They expanded trade and kept personal consumption below economic growth. Less consumption and borrowing plus a trade

surplus increased Dollar, Euro, and Yen

reserves.

Think

China and Russia.

3. Aggregate demand stagnated

as trade surplus countries didn't spend. Germany's 2005 economic

renewal was saved and Japan's private sector saved much more after

their 1990's credit bubble exploded. Adding to the demand shortage

were companies who maintained profit by decreasing capital investment

spending despite historically low interest rates. Globalization and technology also

helped them maintain profit as wage increases were limited to most valuable employees.

State and local governments, especially those with underfunded pension systems, also cut

expenditures.

Think

Mercantilism.

4. Increased current account deficits by wealthy nations balanced world trade.

Higher demand for

foreign goods

was made possible by massive central bank supported |

low interest

loans. The FED's historic monetary expansion was made possible by

continued low inflation caused by expanded Flat World competition

and low oil prices. Innovative financing and lax financial regulation also fostered

expanded financial asset demand.

Think excess OPEC savings

financed the 1970's

Latin American Debt Crisis leading to Savings and Loan Crisis.

5. Real Estate and Stock bubbles came as

expected from low long-term real interest rates. New home buyers borrowed surplus savings and

investors devoured growing unique debt securities created by an expanding

finance industry promising insured difficult to understand

almost guaranteed financial instruments.

Leverage rose dramatically. Fraud, near fraud

and data manipulation exploded. See

Brief History of Financial Bubbles.

6. Poor Crisis Management by politicians as

their economic advisors believed market capitalism would prevent

serious recessions. The

Great Moderation solidified this view. Possibility of new financial

instrument contagion were not understood. When panic started,

political, intellectual and bureaucratic leaders resisted quick action in areas

that required cooperation. A

US depression was avoided by FED, Treasury and Congressional efforts

that were slowed by austerity. Iceland, Ireland, Greece, Spain and

Portugal experienced economic depression.

See

The Great Recession.

Part 2 Financial Bailout, Economic Recovery, Poverty Stuck at 15%, Income Stagnates

and Wellbeing Grows

12/18/15 |

|

Financial Bailouts, Economic Recovery,

Poverty Stuck at 15%, Profit vs. Labor, Wellbeing Grows, Asian Competition |

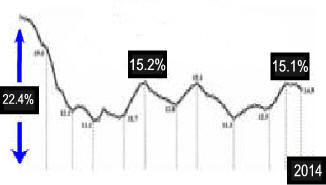

New Normal # 5

Poverty Stuck at 15%

Some believe the 15.5% poverty rate should

be lowered. After "...correcting the

2013 poverty rate for noncash food and housing

benefits, refundable tax

credits, and the upward bias in

the CPI-U ..."the rate drops from 14.5% to

4.8%.

War on Poverty-Was It Lost

Others believe it should be raised as

it doesn't account for geographic and demographics differences.

See

Poverty Rates How Flawed Measure Drives Policy

Other

Data 1

Data 2 Think many use true but not

necessarily appropriate data to foster their POLITICAL beliefs.

Example: With our obesity problem how could anyone have believed that many went to bed hungry during the

Great Recession. Calculation ignored food stamps and subsidized

school lunches. |

|

New Normal # 6

Profit

Beating Labor

Twenty-first century war expenditures helped profit recover after a

dot-com

bubble recession, then crash with The Great Recession and then

grow to

new heights. US Companies have competed very well in a flat world using

technology, outsourcing to Asia, Mexico...and by keeping wage

increases low.

Source Total compensation has done better although Obama Care gave companies an opportunity to again lower compensation.

Source New Normal # 6

Profit

Beating Labor

Twenty-first century war expenditures helped profit recover after a

dot-com

bubble recession, then crash with The Great Recession and then

grow to

new heights. US Companies have competed very well in a flat world using

technology, outsourcing to Asia, Mexico...and by keeping wage

increases low.

Source Total compensation has done better although Obama Care gave companies an opportunity to again lower compensation.

Source

More

Data 1

Data 2

Think Rust Belt then NAFTA and soon TPP?

|

|

New Normal #7

Wellbeing Increased Continually

|

1. Society's continued stability has resulted in tremendous economic growth

which is

the key determinate of well-being.

Public safety net,

child

safety, and

adjusted poverty rate have all improved

dramatically since the

Gilded Age. Think

economic continued economic distress in

Russia, Europe, Japan and China.

2) Scientific achievements have continuously added to citizen well-being.

Think cured diseases, smart phones, streaming audio-video, Gillette Stadium ...

See

Health Problems Solved.

3) Personal Income increased continuously if not always rapidly

because nature and nurture improved the personal characteristics

needed to enhance wellbeing.

Think Russia, China, and

Europe's really slow recovery from the Great Recession. Source

Is The Country In Trouble,

Will Stagnate Income Hurt Our Children and

Recent

Decades Ranked By Problems.

see

Crisis of

Capitalism 11:10 video is an interesting Marxian view i.e.

Bernie Sanders

Return to page 1 Send thoughts to

antonw@ix.netcom.com |

New Normal # 8 Asian

Competition

|

|

1. The Good

Cold War to 1980

AD > AS

Full Employment Goal =

Inflation, Debtors Paradise

US

Credit Expansion

equates AD with AS. |

2. The Bad

Neoliberal Economic Reset 1980-2008

AS > AD

Business Responded to Inflation

Led to

Deflation. a Creditors Paradise

|

3. The Ugly

Reactions to Neoliberalism

2008-

Sustained

Deflation

Created Winners-Losers

Globalization Failed

Pickett's R > G

Back to Equilibrium with Increased Income Inequality |

|

to 1980

Politics

Strong Unions

Restricted Labor Markets

Central Government Strong

Central Bank Weak

Finance Weak

|

1980-2008

Politics

Weak Unions

Open Flexible

Globalized Labor Markets

Government Less

Economic Responsibility

Central Bank

More

Economic Responsibility

Finance Strong |

2008-

Politics

Lack of Bank Regulation

High

Leverage

Short-Term Reserves Were in

Euros

When Dollar Were Required

Academic Economist Ignored Economic Effects of Financial

Market

|

Economics

Sustained Inflation

Wages Got All-Time High

Capital Got All-Time Low

Real Debt Decreases

Inequality Low |

Economics

Secular Deflation

Labor Got All-Time Low

Capital Got All-Time High

Inequality High |

Economics

Government Helped

Top and Bottom

Creating Middle Income Envy

|

Economic

Theory |

Manorialism

had Lords with

legal economic power supported financially from his landholdings with legal obligatory contributions of the peasantry. |

Tariffs increased powerful, helped private "infant"

industries. Trade was limited

with

industrial specialization

providing

growth.

|

Private property, individual liberty

|

backed by a

constitutional

Democracy. |

Property/Contract Rights

eventually yield to

human

Rights/Liberties

See

Lochner v. NY |

Free Markets Rule

GATT Globalism

WTO aid Agriculture |

Nationalistic

Backlash |

|

Surplus |

Agriculture + Gold +Luxuries |

|

Diseases Cured, Basic Necessities |

Preventive Medicine |

Retirement |

|

Oligarchs |

Church + Monarchy +Guilds

+Traders

+ Merchants |

+ Corporations |

Wealthy Few +

Politicians |

+ Interest Groups |

+ Social Media

moguls |

|

Control

Method |

Eternity in Hell or Heaven+

Physical

punishment |

+ Economic Rewards |

+

Political Rewards

|

+ Self Interest |

|

Work Structure |

Wool Weaver Households |

Cotton Factory Workers |

Unionized Manufacturing Workers |

|

|

Taxpayers |

Surfs + Farmers + Guilds

+Bankers +Importers |

|

+ Corporations |

|

+ Individuals |

|

Waste |

+ Military

Spending |

|

|

+ Education Spending |

|

Oligarchs Provided |

Safety |

+

Infrastructure |

|

+ Sanitation + Health |

+ R&D +

Universal Education

|

+

Education + Security |

|

Oligarchs |

Anarchy |

|

+ Trade Unions |

|

+ Government Replace Unions |

|

+Social

Networks |

|

Key Asset |

Land + Gold |

Natural Resources + Transportation |

|

|

Energy Source

|

Humans Animals, Water, Wind

|

+ Steam

|

+ Electricity |

+ Oil |

+ Atom

|

+ Nature |

|

Key Exporters |

India, China |

+ England |

+ US + Germany |

|

|