Preface

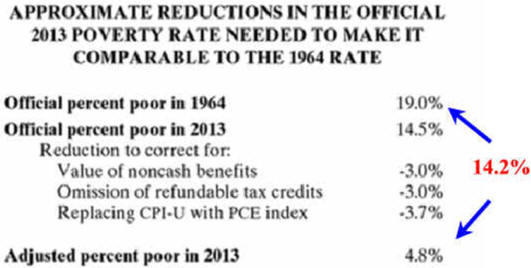

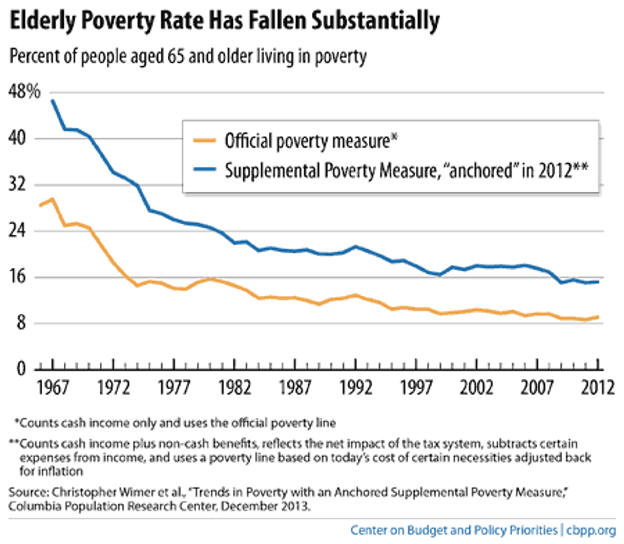

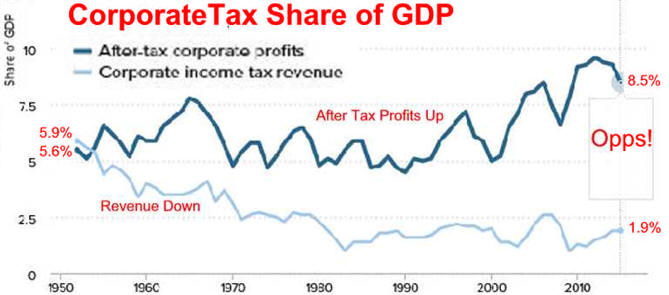

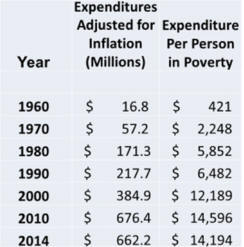

Economists incorrectly measure

inflation, a basis for correctly measuring other important

economic statistics?

Mostly products

I use in retirement were not available to my dad who retired In

the

late 1970's,

when economist

preach the US wellbeing had began to decline.

These are the very inexpensive products I use daily:

Laptop, Internet, My Website, Smartphone,

Streaming 4K TV, Sirius Radio, Podcasts,

Facebook, and You Tube political economy videos.

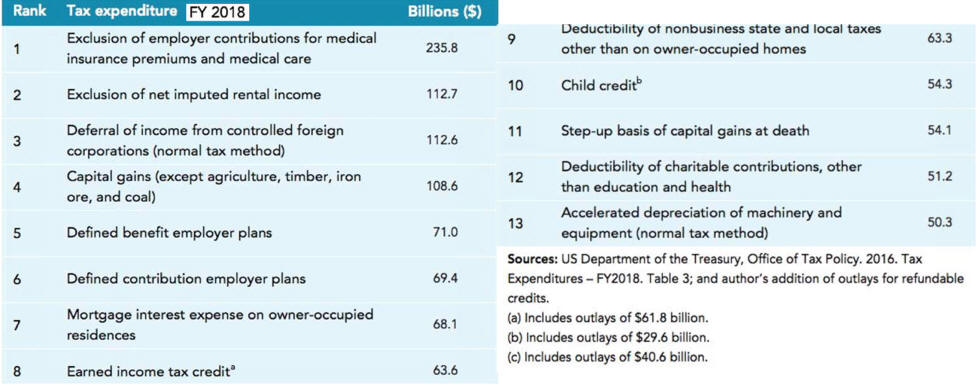

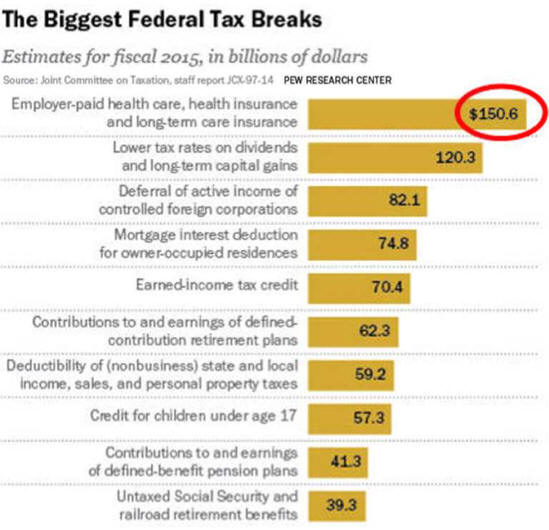

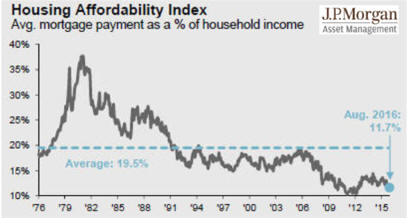

Medical expenses and

college tuition are measured at gross price which is seldom paid by

consumers.

Measured appropriately, income

and productivity are

not falling.

Why don't more people understand our current populism has happened before. U.S. Terror Episodes Since 1900

A capitalist, democratic,

federalist, capitalist economy changes very slowly.

For 400 years, half our immagrants were looking for freedom and the other half were looking to make a buck.

Return to What You Should Know About Updated 4/15/23 Please link to, use to educate and share.