VII.

Income elasticity

is the % change in quantity demanded divided by the % change in income.

A. Income elasticity is positive for normal (superior)

goods such as steak

and vacations - more is purchased as income

increases.

B. Income elasticity is negative for

inferior goods such as bread and

hamburger-less is purchased

as income increases.

C. In times of recession, income

elasticity determines

loss in

revenue by

producing

firms.

D.

Selected

income elasticity's Wiki

E. Income Elasticity of Demand

F. Visit

Income

Elasticity of Demand from tutor2u for

more information.

VIII. Cross elasticity

of demand

is the % change in quantity demanded

divided by the % change in the price of a substitute or complement.

A. Cross elasticity is positive

for goods that are substitutes (price of hot dogs up,

quantity of hamburger sold up).

B. It is negative for goods

that are complements (price of hot dogs up, quantity of hot

dog rolls sold down).

C Near zero for independent

goods (peanuts and grapefruit)

C. Cross

Price Elasticity of Demand from tutor2u

D.

Income

and Cross Elasticity Video from ACDC Econ

E. Virtual

Economy from Buz\ed

has an elasticity calculator. Please

IX. Price elasticity of supply is the % change in quantity supplied divided by the %

change in price.

A. It is a function of how factor costs

change as more is produced and the passage of time.

B. If costs (factor prices such as wages

and rent) change little as more is offered for sale at higher selling prices

then profit potential is high and supply will be

elastic.

C. Supply elasticity also increases with

time as companies have more time to adjust to higher costs.

1. Unusually high

demand for tomato's or the Chrysler PT Cruiser take time to produce and supply is

inelastic.

2. Gateway may be

able to increase the number of a new popular

model computer quickly and supply

is more elastic.

D. Gold production is costly and takes time so

price is volatile because of frequent demand changes.

E.

Selected

supply elasticity's

F. Visit

Price elasticity of supply

from tutor2u for more information

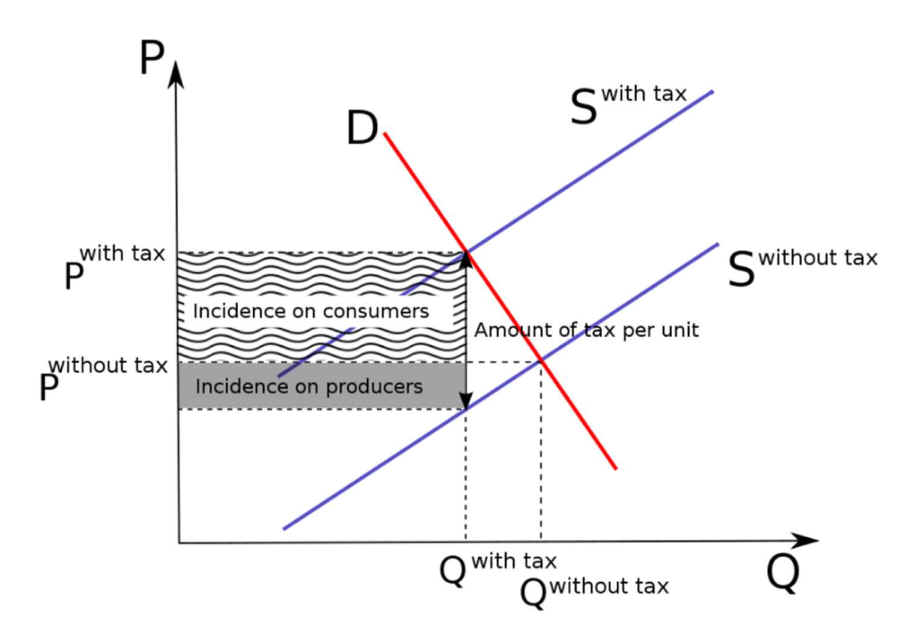

A. Effect on tax incidence

B. History of Price Elasticity- Wiki

C. Why Current Methods to Combat Climate Change Don’t Work

D. Economic Surplus of consumers and producers is explored in the next chapter.

B. Price is up much more than

B. Price is up much more than