|

Great Recession Return to Current Political Economy Issues 4/14/18 Please link to, use to educate and |

|

Great Recession Return to Current Political Economy Issues 4/14/18 Please link to, use to educate and |

|

New Normal #1

|

New #2 Oil Embargos and Japanese Competition Began Wage Stagnation

Japan's competitive manufacturing sector accelerated causing stagnate Rust Belt wages and employment. Why? Japan got lucky when gas efficient small green cars required change and U.S. manufacturing responded by protected profits with less quality improving capital investment. They also got unions to accept a two-tier wage system that minimized wage increases for new workers. Pressure on foreign manufactures resulted in them building new U.S. plants. |

|

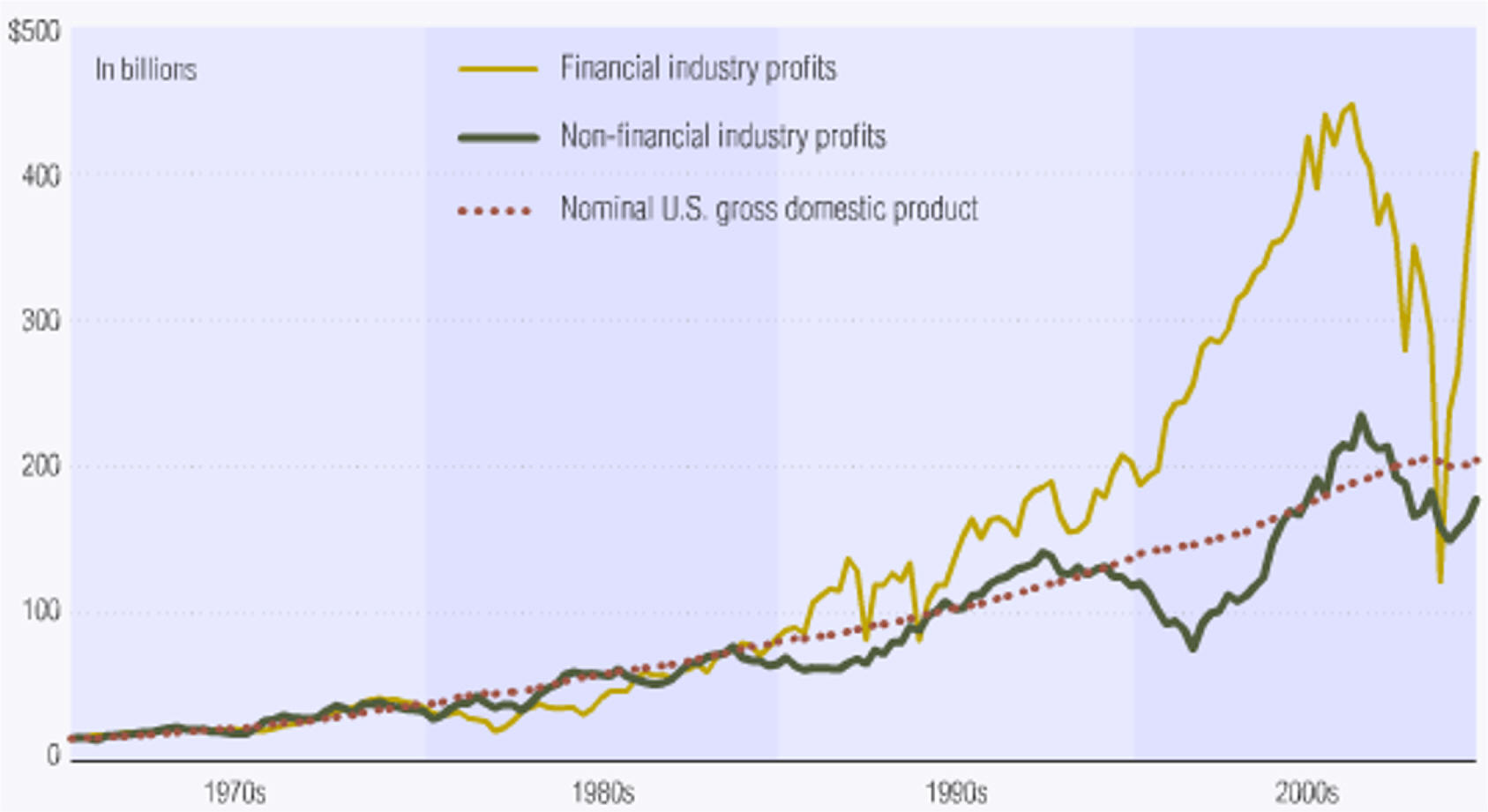

#3 Philosophical Change Causes Financial Instability 1980 Depository Institutions Deregulation and Monetary Control Act began a return to Conservative Business Regulation caused by adverse voter reaction to increased government regulation and welfare spending. Think Great Society and lax derivative regulation. 1980's Major Investments Banks Went Public creating a need to balance client needs with equity needs. Think expansion of financial industry. 1980's Accounting Standards Declined as accountancy firms struggled to balance their commitment to high audit standards with the desire to grow their consultancy business. Think off-balance-sheet items and Arthur Anderson Scandal. 1980's Home Equity Loans Increased Current Consumption and Lowered Savings as they replaced home improvement loans. Think many not prepared for retirement. |

|

From

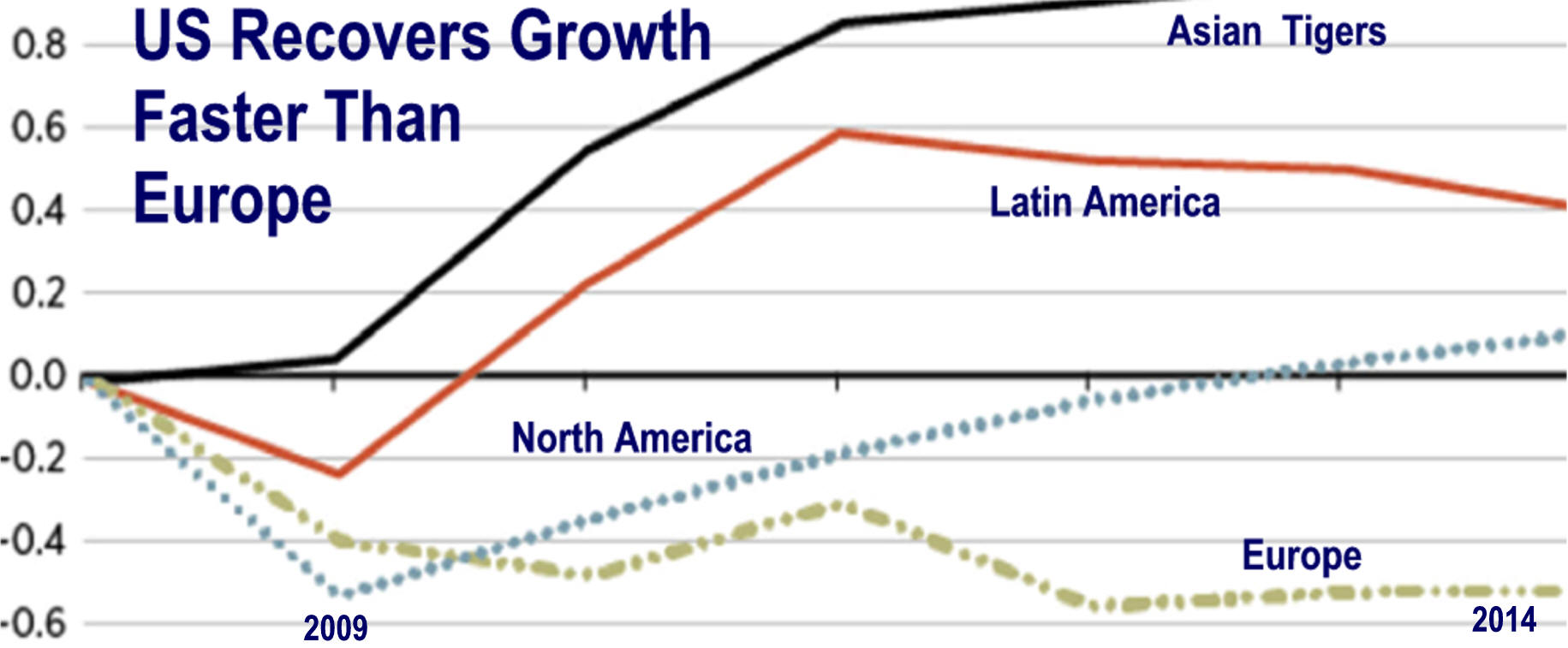

Financial Crisis to Recession to Great Recession 1. 2007-8 Financial Crisis was tamed by the Federal Reserve. 2. 2008-9 Recession was tamed by monetary and fiscal policy. 3. European financial instability and world-wide austerity slowed economic recovery which added to slow secular income growth for all but the very, very, very wealthy. Think top 1/10th of one-percent. 4. Great Recession Recovery Has Varied Around The World |

|

Understanding Balance Sheet Recessions. |

What Led To The

Great Recession?.

1. Free Market Capitalism Lowered Regulation. 2. Innovative Expanded Investment Banking.

3. Global Trade Imbalances Built a Savings Glut |

|||

|

China 2012 Germany 2012 Saudi Arabia 2009 Japan 2011 Russia 2012

|

214B 208B 150B 119B 81B

|

$ |

||

|

Great Recession Stages

from

The Shifts and the Shocks by Martin Wolf 1. A more complex unstable large1 financial/credits system evolved creating extreme optimism in good times and panic in bad times. Think derivatives, securitization, credit default swaps all managed by hedge funds. 2. Emerging countries lowered borrowing and increased trade surpluses creating a savings glut after the 1997 Asian Debt Crisis made their foreign dollar dominate debt buildup unsustainable. Instead they expanded trade and kept personal consumption below economic growth. Less consumption and borrowing plus a trade surplus increased Dollars, Euros, and Yen reserves the world's spenders could borrow. Think China and Russia. 3. Aggregate demand stagnated because high income countries like German, Japan and OPEC increased trades surpluses. Germany's 2005 economic renewal was not spent and Japan's private sector saved much more after their 1990's credit bubble explosion. Adding to these demand shortage were companies who maintained profit by decreasing capital investment spending despite historically low interest rates. Globalization and technology also helped them maintain profit as wage increases were limited to most valuable employees. State and local governments, especially those with under funded pension systems, also cut expenditures. Think workers maintain living standards with home equity loans. |

4. Increased current account deficits by wealthy countries

balanced world trade. Higher demand for

foreign goods was made possible by massive central bank supported low

interest loans. The FED's historic monetary expansion was made

possible by continuing low inflation resulting from expanding world competition

and low oil prices. Innovative financing and lax regulation also fostered demand

expansion.

Think excess OPEC savings

caused

Latin American Debt Crisis.. |

|

Recovery Was

Historically Slow

Though Not

For a Balance Sheet Recession 1. Chart Book: The Legacy of the Great Recession 4/13/18 10 YEARS AFTER THE CRISIS for more data |

2. Econ Talk Podcast

Recession, Stagnation, and Monetary Policy EconTalk Podcast 1/9/173.

3. Mark Blyth: After the Financial Crisis: How to Tell the Forest from the Trees 57 min. video 4. Have Big Banks Gotten Safer? Brookings' Report Fall 2016 |

|

Part

Two |

|

A Quick U.S. Bailout History The $700 billion 2008 financial-sector rescue plan is the latest of many bailouts that go back to the Panic of 1792 when the federal government bailed out the 13 over-burdened by their Revolutionary War Debt 13 states. Private commercial banks and investment bankers took over and led financial bailouts until the Panic of 1907 when the economy was so big that J.P. Morgan needed US Treasury help. This led to the 1913 Federal Reserve System designed to be the lender of last resort. |

Recently the 1987 Savings and Loan Crisis bailout cost about $160 billion. Other recent government private industry bailouts have included: 1970 Penn Central Railroad 1971 Lockheed Corporation 1980 Chrysler Corporation 1984 Continental Illinois 1991 Executive Life Insurance Company bailout by states assessing other insurers and the 1998 Long-Term Capital Management bailout by commercial and investment banks. Think overcoming greed is difficult. US does better than most! |

|

Recession Cost Were High But Growth Cured Budget Problems Economic Cost of Great Recession Estimated at 12.8 Trillion. Some add the loss in home values but this is a reach since the housing bubble had inflated values. US FED Profit of 100b in 2014 were up from 47b in 2009 and with 420b from 2010-14. Source See Treasury financial analysis of Great Recession in Charts Think this is how we don't pay for war. |

|

|

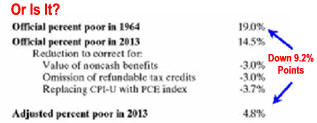

Chart 2 ". provides a first approximation of how correcting the 2013 poverty rate for noncash food and housing benefits, refundable tax credits, and upward bias in the CPI-U would change the 2013 poverty rate. With these corrections the official poverty rate falls from 14.5 to 4.8 percent, making the 2013 rate roughly a quarter of the 1964 rate (19.0 percent). If we were to lower the poverty threshold for cohabiting couples to match that for married couples the 2013 poverty rate would have fallen even more. From War on Poverty-Was It Lost NYT 4/2/15 Other Data 1 Data 2 Think different political philosophies use true but not necessarily appropriate data to make their share of the pie. With our obesity problem how could many have one to bed hungry during the Great Recession. |

# 5

|

Twenty-first century war expenditures helped profit recover after a dot com dot-com bubble recession, then crash with The Great Recession and then they grew to new heights. US Companies compete very well in a flat world using technology, outsourcing to Asia, Mexico...and by keeping wage increases low. Total compensation has done better though Obama Care has given gave companies an opportunity to again lower compensation. Source More Data 1 Data 2. Think Rust Belt then NAFTA and soon TPP. |

|

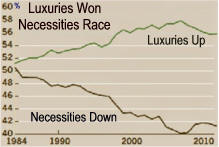

| #6 Most Significant Normal, Wellbeing,

Continually Increased

1. Society's stability has resulted in tremendous economic growth which is key to individual well-being.

The

public safety net,

child

safety, and

poverty rates after non-cash transfers have all improved over the last

100 years. Think economic distress in

Russia, Europe, Japan and China. |

Source #1 Source #2 |

|