|

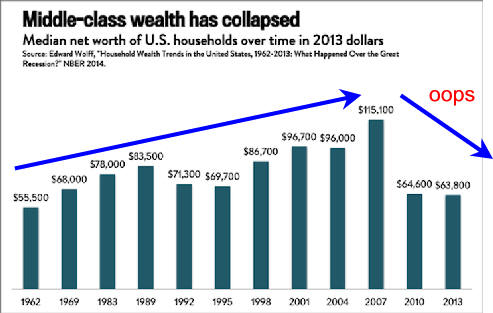

Is Middle Class Wealth Fall a Crisis? 3. Home Ownership: Entry Into Middle Class 4. Since 1917 Extremes Got More GDP Pie 5. Middle Class Share Declined 6. Has Safety Net Adjusted Enough? 7. Analysis Will Trump's Trickle Down Work? 8. Middle Class Economics (textbooksfree.org) Discussions Questions Where Have All the Good Jobs Gone? Will Inflation/Growth Solve Pay Deficit? Will Debt Bring Down US Capitalism? |

|

Source See The Great Recession Casts a Long Shadow on Family Finances

|

||||||||||||||

|

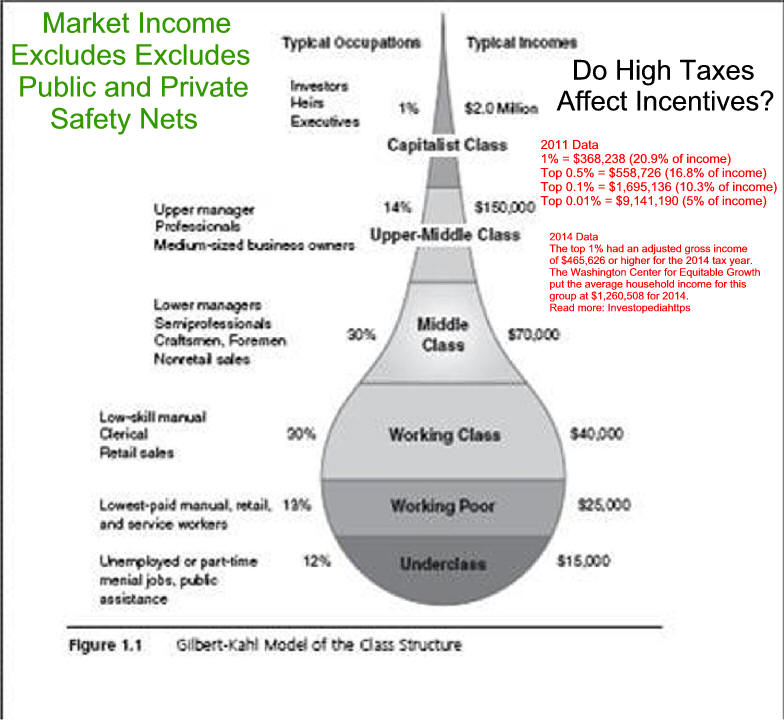

1.Class Structure Must Be Defined

|

|

Source See Forget the top 1% — Look at the top 0.1% and How Much Income Puts You in the Top 1%, 5%, 10%?

|

2. Recent Income and Wealth Distributions From Wolff (2014); only mean figures are available, not medians.

Table 1: Income and net worth in the U.S. by class, 2013

Editors Note: Mean is Higher than Median

|

|

||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||

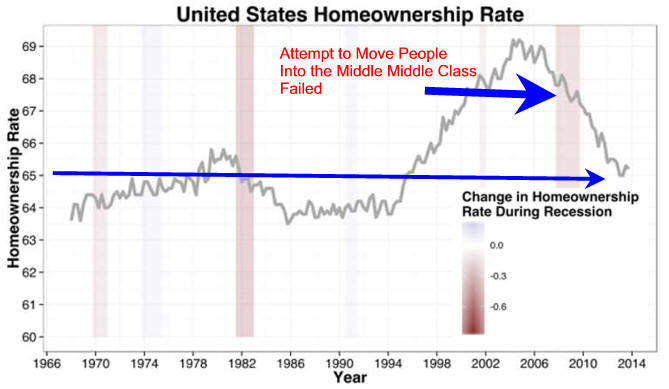

Historical Homeownership Rate

1890 through 1970

|

|||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

|

|||

|

Political Efforts to Failed

|

|||

|

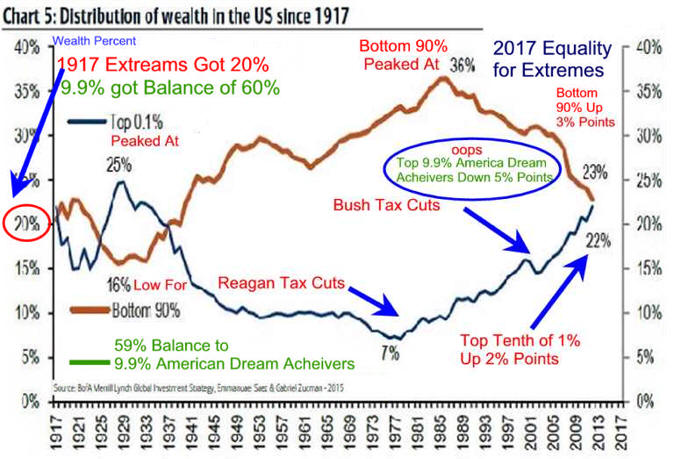

4. Since 1917 the Extremes

Urban Institute Believes Upper

Middle Class is the Big Winner |

|||

|

5. Middle Class Share of Income Declined

|

|||

|

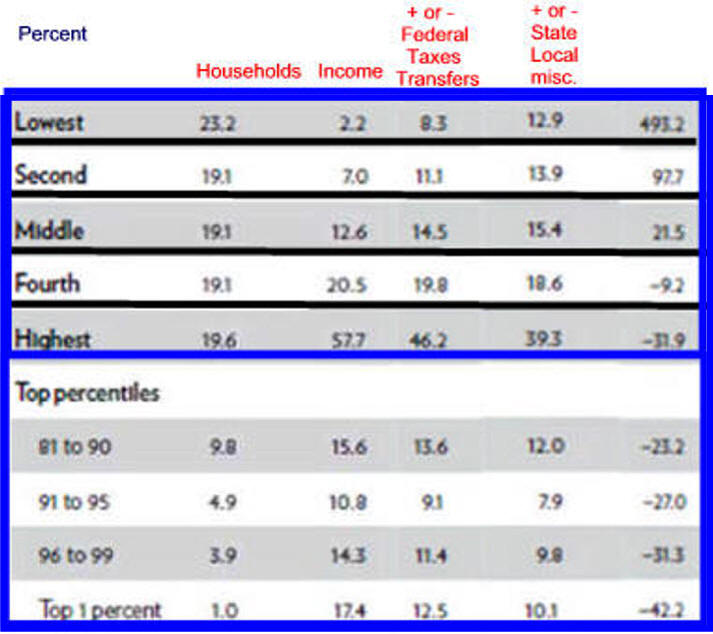

6. Has Safety Net Adjusted Enough?

|

|||

|

|

Editor's Note: A similar analysis adding the

present value of Medicare and Social Security

Trump Voters looked out the window, saw the giveaway,

|

||

|

|

7. Analysis Will Trump's Trickle Down Work?

|

||

|

|||