Is Capitalism to Blame for Middle-Class Plight

Return to Economic Issues Updated 2/5/18 Please link to, use to educate and

WWII Created Unsustainable Expectations.

American industrial base enjoyed twenty-five years of monopoly power after WWII because Great Brittan, Germany, and Japan had to replace their industrial base. This resulted in U.S. workers enjoying extraordinarily high income and fringe benefit growth.

The next twenty-five years period began with extremely high inflation which began with excess aggregate demand caused by government debt to fight the Vietnam War. This inflation was reinforced when the OPEQ cartel substantially raised oil prices. This lowered the living standards of nonunion middle-class worker and most retirees.

About this time U.S. companies faced competition from newly developed industrial technology from Japan, German and Great Brittan. America’s older industrial base would suffer. American executives maintained company profits and their high salaried jobs by cutting worker wage. They also cut product quality making competing with high quality foreign competition more difficult. Union’s leaders also wanted to keep their high paying jobs so they convinced union members who also wanted to keep their high paying jobs to accept buybacks. They also allowed newly hired workers to earn lower wages and fewer fringe benefits. The financial industry also faced more foreign competition from foreign bankers and cheap Internet trading. They countered with exotic products such as derivatives and Credit Default Swaps. Problems resulted.

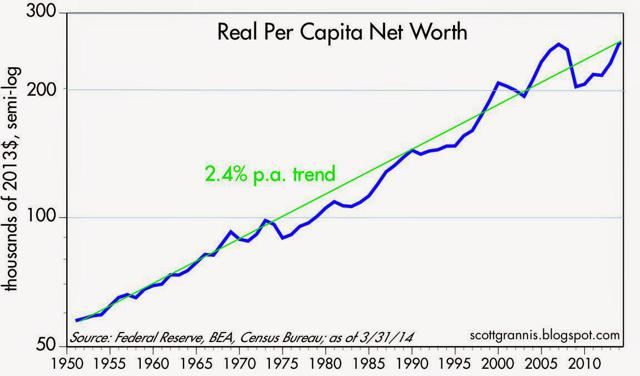

U.S. Consistently Produce

a Lot of Wealth (accumulation)

http://seekingalpha.com/article/2255423-solid-gains-in-household-net-worth?ifp=0

Borrowing Keeps Living Standards High.

Worker adjusted to stagnant wages by using credit cards to increase living standards. Then banks changed the name of home improvement loans to home equity loans and homeowners increased their standard of living by spending equity savings.

Politicians continued to buy votes with deficits. These deficits increased the well-being of both worker and retirees. Politicians also tried to help average earners buy homes by encouraging the financial community to make mortgages easier to obtain. The real estate industry and banks took many shortcuts to speed up mortgage processing and dramatically expanded issuing mortgages. Bank and Politicians did not realizing they had creating massive liquidity problems leading to the Great Recession.

Many Americans are better off. Most Older Americans have been pulled out of poverty by SS, Medicare and the accumulation of wealth which occurred following WWII. Children are better off because childhood diseases such as polio have been cured, seat belts and bike helmets are now required, school transportation safety has been increased and they have wealth grandparents to spoil them. Many baby boomers received an larger inheritance than that received by their parents. Many baby boomers also have company retirement plans and they have enjoyed society's vastly improved safety net designed to help the poor. See Economic Wellbeing.

Dissatisfaction with capitalism, politicians, educators and business exists because people compare present economic well-being with the unsustainable twenty-five occurring after WWII. The last time similar events occurred was after WWI and the resulting balance sheet recession caused the Great Depression. It ended with substantial WW 2 industrial activity and debt.

WWII solved the problem of Fascism but left us with equally feared Communism and more debt than we have today. Today’s debt was make life more enjoyable. WW 2 debt was wasted on war. Rapid economic growth after the war increased GDP, kept interest rates low, and the U.S. easily refinanced the her debt.

The Future

Fear that slow economic growth will make current debt refinancing expensive has people apprehensive. So does the expense of future commitments for society’s safety net. Slow growth will eventually require restructuring which will hurt many. Is a post WWII productivity which lowered relative debt possible? Can we continue cheap refinancing and generate the production necessary to continue funding an expensive social net?

A return to the Great Depression after WWII was predicted by many. It never happened because rapid growth caused by pent-up consumer demand resulting from WWII savings and rationing. Economic production created by the needs of a large baby boomer generation added to aggregate demand as did increased demand from government spending on the Marshal Plan and the national highway system. Where will growth come from?

Fracking has begun to lower energy cost and make U.S. based production more competitive. Millennial having grown up in the Digital Age may be able to create the U.S. monopoly power required to rapidly expand the economy and lower the relative cost of debt. The United States is better equipped to succeed in a Flat Robotic World than any competitor.

What happens if growth is delayed or doesn’t happen? Politicians will not act until the expense of carrying an ever increasing debt hurts them poetical. Thankfully this will not happen quickly because the dollar faces little competition. The acceptance of the Euro and Renminbi will be very slow, but it may eventually happen. Voters are receiving many benefits from annual deficit and want to discontinued. They only accept lower government expenditures helping others people.

What Makes Me Nervous

A disastrous rollout of Obama Care increased cost much more than expected and creates such a doctors shortage that Republicans gain control of Congress and cut back dramatically on the social safety net. Unemployed college graduates join with dissatisfied poor people and may cause social unrest not seen since the 1960's; a time when people were not nearly as spoiled as they are today!

After Tax Income Went Up for the Middle

Source Transfers payments and taxes decreases inequality CBO 2011

Those at the Bottom Got Less

Market

Income Plus

Transfer

Payments and Minus Federal Taxes

| Quintile Median | 1st | 2nd | 3rd | 4th | 5th |

| 1979 | 7,707 | 19,131 | 26,596 | 35,708 | 78,520 |

| 1989 | 7,392 | 19,324 | 28,663 | 40,254 | 104,318 |

| 19 | 8,709 | 22,344 | 32,688 | 46,157 | 139,325 |

| 2007 | 9,290 | 24,374 | 35,985 | 51,379 | 166,871 |

| Change | 1,584 | 5,243 | 9,390 | 15,672 | 88,351 |

| % Change | 21% | 27% | 35% | 44% | 113% |

Source Transfers payments and taxes decreases inequality CBO 2011 Table A