Federal Debt Analysis

A Third Debt Crisis? No one Pays the Federal Debt

21st Century Could Be Different

A Little Economic History

Related Sites

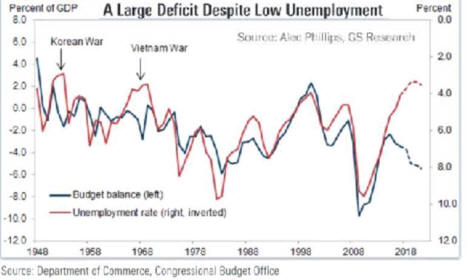

Deficits

Inflation

Unemployment

See

2024-25 Economy

5/12/25

A Third Debt

Crisis?

2025

to be

Growth Without Excess Borrowing

Through the 20th

Century,

No-one Has Paid the

Federal Debt,

Modern Fiscal Policy Rolled it Forward

Federal Debt had little effect on Mom and Dad

who died in their late

80's.

Their Four Children, now all in their 80's, didn't have been little

efected.

If politicians let the Fed Res roll debt forward slowly,

my brothers 8 kids, now in their 50's, will not be effected.

We Just Grow it into Insignificance

US Has Grown Out of Debt Before

21st

Century Could Be Differents

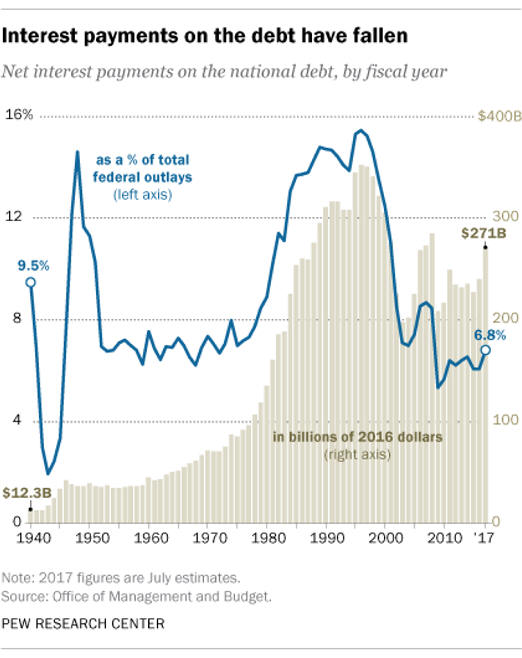

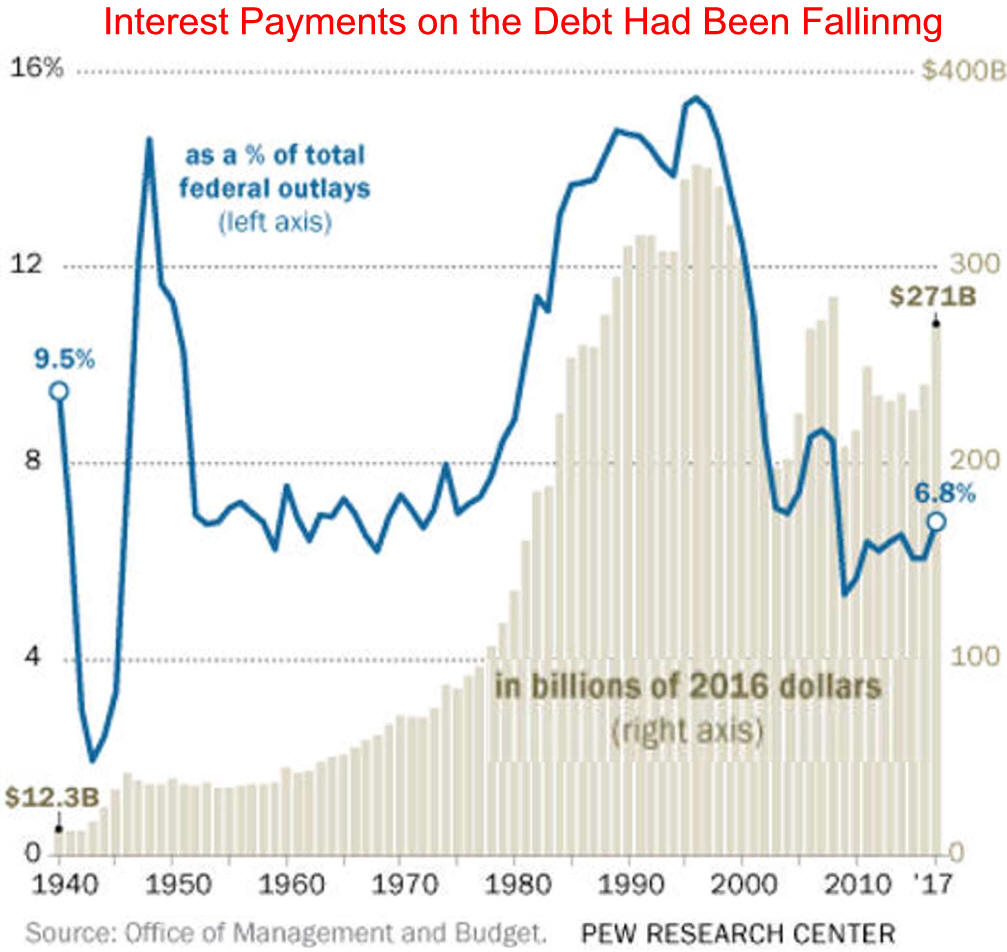

Interest Expense Could be High

The

real

interest expense on the

net

federal debt

driven by

rising interest rates

and

increasing debt levels is expected to be

$881 billion.

Market

Issues of April 11, 2025

raised the interest expense stakes

in Trump's poker game with the US/World economy.

So Trump held rather than raise and Xi began an Asian tour.

Two Kinds

of Federal Debt

1. Bonds/Notes pay interest to owners.

2. Dollars pay no interest.

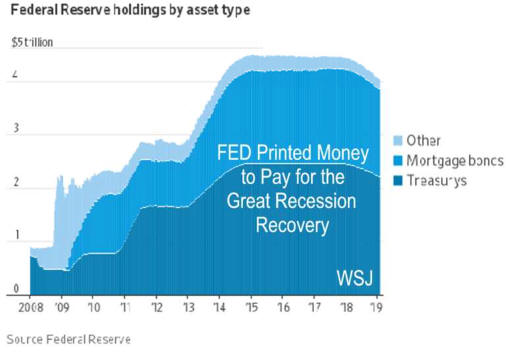

Transactions only occur in dollars, which the FED prints as needed.

Fed can print dollars, give to treasury to spend, all with no

interest.

The hitch: If we

have a big deficit in 2025-6,

the Fed Res may not be able to easily roll debt forward debt.

without paying high Interest rates.

This is new ground for the FED because interest rates ate much higher.

See 2024 Deficit Analysis or Candidate Tax Positions

US Federal Debt Began With War

FDR Used Debt to Feed People

Republicans Cut Taxes

Source The Long Story of U.S. Debt, From 1790 to 2011

Excess Money Printing Could

Cause

Inflation Leading to Higher Interest Rates/Cost

They did it again for Covid Shutdown