|

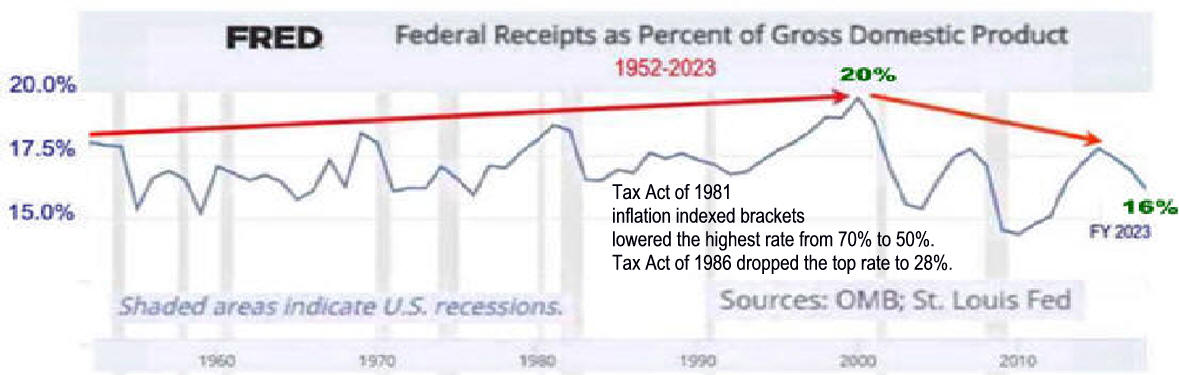

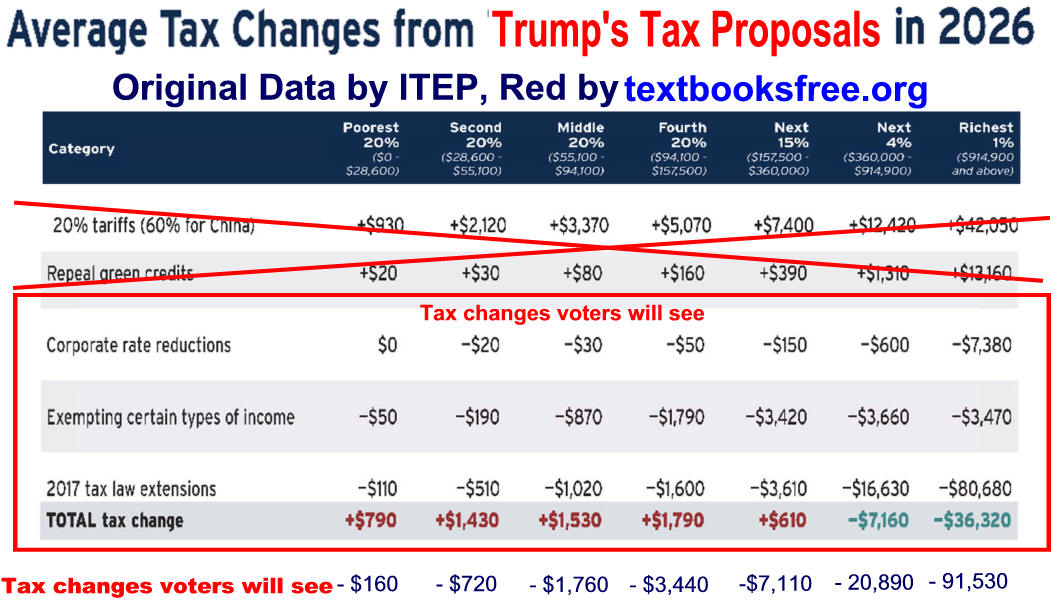

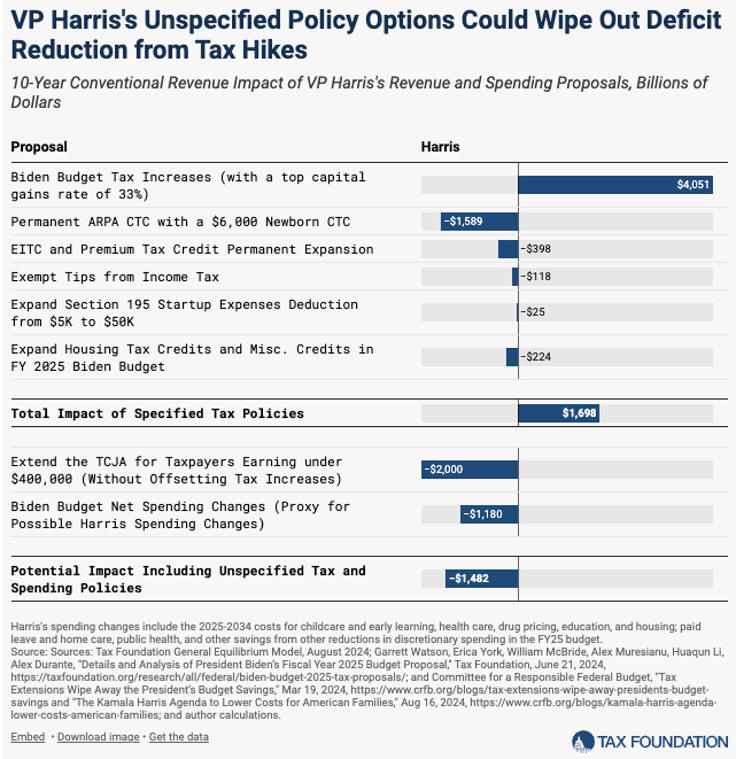

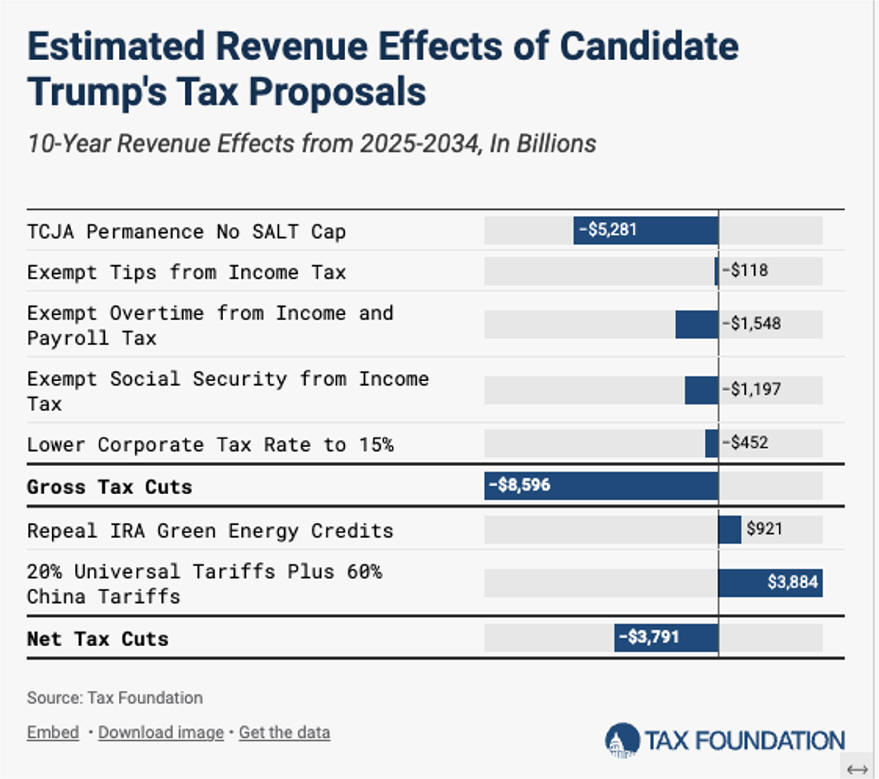

Trump -Everyone Pays Less Harris - Rich Pay More1. Tax Revenue Down to 1960s Lows

2.

Candidate Tax

Proposals |

|

Tax Revenue Down to 1960s Lows

|

|

Whose to Blame 2024 Economy |

Who Pays US Taxes?

|

Analysis

Personal Income Tax |

|

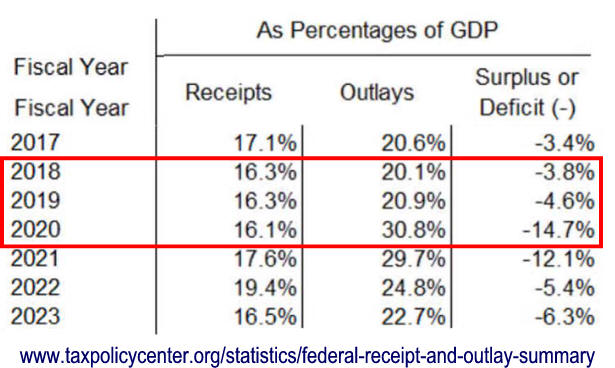

Should 2018 Tax Law Extend? |

||

|

|

|

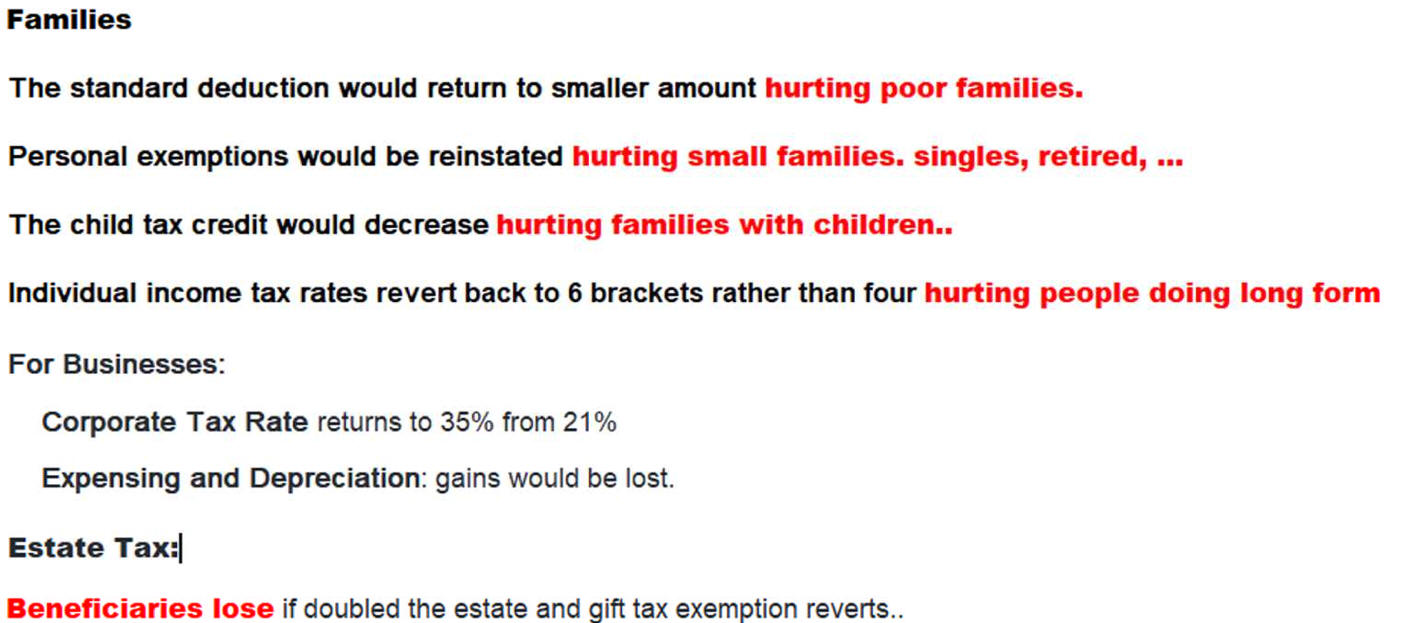

Key is Effect of Extending Entire 2018 Tax Law |

|

|

Reverse

21% the corporate tax rate

to pre-law 35% rate

brings in lots

Co

1. Sustained IRS funding increases targeted brings in lots2. Support a global minimum tax eventually may bring in lotssee Deficit Analysis |

|

|

|

|

|

|

See 2. Tax Expenditures 3. Personal 4. Corporate 2024 Election Information

|

Not Extending 2017 Law Means

Tax

Rates are 10%, 12%, 22%, 24%, 32%, 35%, and

37%. RETURN TO RATES 10%, 15%, 25%, . 28%, 33%, 35%, and 39.6%

|

||

|

A House bipartisan bill

A Senate vote is expected. Was law designed to provide political fodder for 2024 elections?

|

||

|

Vance

opposes free trade and advocates for the mass

deportation of

undocumented immigrants.

(Khan has appeared on the Planet

Money podcast;

you can listen

to our interview with her here)."

And

I guess I look at Lima Khan as one of the few people in the

Biden Administration that I actually think is doing a pretty

good job. And that sort of sets me apart from most of my

Republican colleagues.” Vance’s (Fraying) Alliance With Progressives On Economic IssuesAfter the East Palestine train derailment, Vance partnered with Sherrod Brown (D-Ohio) to try and improve rail safety (the legislation still hasn’t passed). Most prominently, Vance worked closely with Senator Elizabeth Warren (D-Massachusetts) to take on the financial industry, including an effort to claw back the pay of bank executives if their banks fail. After Trump announced Vance as his running mate, Warren made media rounds criticizing his positions on a host of issues, from abortion to tax cuts. Vance has shown a remarkable ideological flexibility over the last decade.

|

||