Trumponomics Centers on Trade

|

Trumponomics Centers on Trade

|

|

Bond Market

Reaction to Reciprocal Tariffs

Trump1's 2018 China Tariff War Yielded $Zero

Let's Hope T2 Does Better Creating Jobs

|

|||||

|

Domestic

Savers and Foreign

Creditors provided most US Deficit

Financing.

Great Recession Crisis:

Long, Shallow, with Little Inflation

Economic growth

and Low Interest Rates

COVID Recession

Was Deep, Short With Much Inflation

Economic growth

might not

limited the

long real economy cost

of Federal Debt Interest Payments The FED has managed this Great Recession money printing credie process reasonably well.

Will Trump

replace tariffs on companies with a tariff on

nations with a US trade surplus.

Watch 1) ten-year interest rates to see if savers

need higher interest to continue leading and

Why Bother With Anti-tariffs

Data

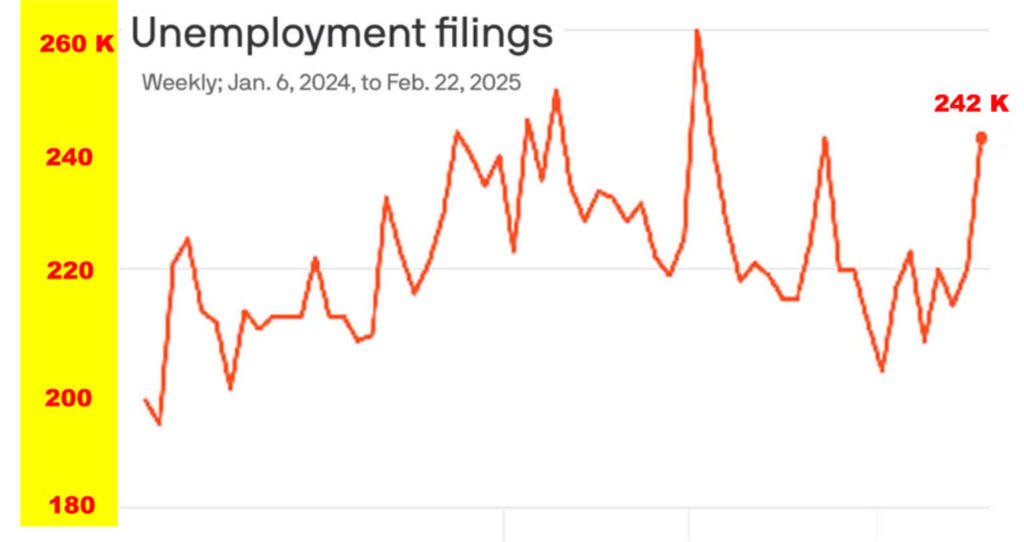

Soon to be Relevant Current

Data

|

|||||

|

With US Capitalism,

|

|||||

|

Americans Own |

Resources | Labor | Capital | Enterprise |

Trade |

|

Owners Receive |

Rent |

Wages | Interest | Profit |

Deficit

|

|

Stuff In &

dollars

out

> Stuff

Out & dollars in.

Dollars come back to US as

foreigners investment in US

Assets, Putin has a bunch of dollars suggestions to antonw@ix.netcom.com

|

|||||

|

|

|||||

| Why Bother with Tariffs Data | |||||

|

|

|

|

Trump appears to asking foreigners |

|

|

|

|

US Economy Back on Track

|

Leads Post Covid Recovery

|

|||

|

Few Crony Capitalists

|

Necessities Cost Less

|

||||

| Political Economy Cycles 1900 -2020 | |||||

|

Source

|

|||