Will

Exorbitant Dollar

Privilege Continue? |

||

|

Thoughts from the Experts

Susan Strange,

British

Professor of International Politics,

believes

Daniel W. Drezner

feels

the US does not have to worry about

these pillars failing, feels the U.S. will tire of having th dollar the world's trade currency and give it up, china and Europe will not want the responsibility.

Others

will take

over. |

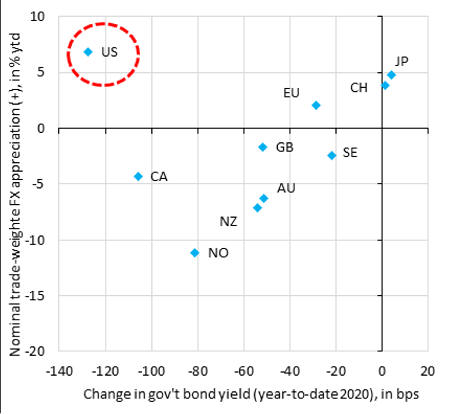

No G10 country comes close to the US "exorbitant privilege," given a rising Dollar & falling yields in the face of massive monetary & fiscal easing. Commodity exporters like NZ have declining yields due to the big global demand shock, which is what their falling currencies signal. 4/19/20 RobinBrooksIIF |

Breaking News 9/16/18

|

|

Crisis Increases Dollar Strength

|

Still No Challenges

|

|

|

Twin Deficits and the Fate of the US Dollar: A Hard Landing Reexamined Confronting Chinese currency manipulation? One of the most widely cited strategies for reducing the likelihood of a hard landing involves confronting Chinese currency manipulation. Proponents of this strategy argue that by hastening an appreciation of the yuan relative to the dollar, U.S. exports will become more competitive, which will act to reduce the trade deficit, and thereby serve to improve investor confidence along with the precarious climate of uncertainty. But as we shall see, this strategy involves significant tradeoffs – for the United States, Asia, developing countries, and the International Monetary Fund. (IMF) – that are likely to undermine its viability and effectiveness. While the obvious benefit of such a strategy for the

United States is – and its resultant success in maintaining a devalued exchange rate – is contingent upon its ongoing purchase of U.S. Treasury bonds. Thus, if the yuan were allowed to appreciate, China would no longer have any need to purchase the vast number of Treasury bonds on which the United States so heavily depends. In forcing China to appreciate, the United States also runs the risk of solidifying its position as a “coercive hegemony.” Already facing much anti-American sentiment around the world, the United States can ill afford to increase resentment by coercing China to pursue an economic agenda that is counter to its own autonomous policy goals. Yet, scholars like Goldstein reject the notion that confronting China would cause a hardening of its position, and argue that Chinese currency manipulation should be subject to the same kinds of criticism that are leveled at its military-build up. China's mounting costs and the waning benefits (of maintaining an inflexible exchange rate system) will ultimately force China to reconcile its employment concerns with those of a moribund financial system (Rajan 2005), allowing China to maintain its own commitment to a gradualist approach to currency reform is much preferable to a coercive policy that calls for immediate adjustment. A policy that begets immediate adjustment is also likely to have adverse consequences in Japan. In considering that the economic relationship between China and Japan is more complementary than competitive, such a policy would conflict with Japan’s status as a net importer of Chinese manufactured goods, and its own comparative advantage as an exporter (to China) of raw materials and goods used for processing, such as steel and machinery. As highlighted above, a rapid appreciation of the yuan would hurt China’s export performance, and cause a general slowdown in the Chinese economy. Because processing makes up a significant proportion of China’s trade, such a slowdown would likely reduce the demand for Japanese exports in certain key industries (e.g. the steel and machinery industries). Indeed, for the Japanese economy, which has become increasingly reliant upon exports to China, a policy that induces an immediate appreciation of the yuan would almost certainly have a net negative effect (Kwan 2003).

|

In responding to employment pressures, China continues to rely considerably upon the performance of its export sector – which is in turn heavily contingent upon a devalued currency. A rapid appreciation of the yuan might very well serve to remedy operational and allocation inefficiencies in the financial sector, but such benefits are outweighed by considerations of a potentially dramatic slowdown in the Chinese economy – and the social and political instability that might result. Finally is the effect that

such a policy might

have on developing countries. It is certainly true that,

like China, much of Indeed, Chinese currency manipulation is a crucial part of

this agenda, Yet, it is doubtful that such a solution would actually address the problems at hand. From the perspective of many countries around the world, the IMF is simply a puppet or manifestation of coercive U.S. hegemony. Pressuring the IMF to recall its original mandate at a time that best suits U.S. interests is unlikely to improve the status of either actor. I have already alluded to some of the tradeoffs for China

in allowing their currency to appreciate. There is no question that

the process by which China abides in maintaining an artificially devalued

exchange rate comes at significant cost. Indeed, China’s sterilized

intervention may lead to inefficiencies in the financial sector and significant

problems of resource allocation (Mohanty and Turner 2006). Many scholars

emphasize, in particular, the substantial opportunity costs that arise

from China’s large accumulation of dollar reserves. For example, Zheng and Yi

point to increased risks for the Chinese financial system, mounting

inflationary pressure, and large losses of wealth incurred by a

weakening dollar The policy proposals that Zheng and Yi offer to mitigate these risks, however, run counter to one that simply labels China as a currency manipulator. Their analysis, in encouraging only “gradual liberalization” and “small-scale diversification” (out of the US dollar), judiciously recognizes the tradeoffs that China faces in terms of having to ensure political stability and address “huge employment pressures” amid a “fragile financial system” appreciation of the yuan could induce severe instability in China that could have potential spillover effects among both industrial nations and developing countries throughout the region. And in the event that China was to harden its stance against liberalization, the possible protectionist leanings that might result in the U.S. from labeling China as a currency manipulator would only serve to foster anti-American sentiment among developing countries. In conclusion, a strategy that aims to unilaterally confront Chinese currency manipulation is likely to be ineffective, and yield undesirable outcomes overall. And as Kirshner’s analysis suggests, true multilateral solutions (i.e., those that do not involve using the IMF as a tool for one’s own agenda) that involve cooperative action on exchange rates are probably beyond reach (Kirshner 2004). Nevertheless, the risk involved in a hard landing for the U.S. dollar requires planned action. The scale of global economic problems today may create an incentive for cooperation in the future, and so efforts to establish coordinated action on exchange rates should by no means be ignored. But the magnitude of the risk is such that the United States would do well to start with targeting solutions that fall directly within its immediate realm of control. Ultimately, in seeking to avert the possibility of a hard landing, a much more appropriate means would utilize “the chief policy tool that we can deploy with some confidence” –reducing the federal budget deficit (Bergsten and Truman 2007).

|