|

Quick Notes by

Walter

Antoniotti Return to Political Economy Book Summaries 6/7/20 Please share! |

||||||||||||||||||||||||||

|

Prelude The Why Low Unemployment became "the" Public Policy Goal to counter Europe's post depression/recession, and Russia's latest 5 year plan.Post WW2 Pent-up Demand increased AD, increasing both US wages and Profits. But the resulting High Inflation pushed interest rates up.

The

FED broke the inflation spiral and lowered interest rates. 2. The Change

Western Business Adjusted

to a mounting profit squeeze

caused by increased flat world's AS.

But wealthy European and Asia

countries ran trade surpluses 3. The Prediction Resulting Political Turmoilwill continue but its effects may be less volatile, or maybe not. Fiscal Policy AD Increases with of infrastructure spending and or helicopter money like tax reductions could help.Government Debt

Guarantees See U.S. Post WW 2 Adjustments Part 1 Part 2 Can Democracy Survive Global Capitalism? 100 min video Political Economy Summary |

||

|

Cold War to 1980 A Full Employment Goal Created Inflationó a Debtors Paradise |

2. The Bad A Neo Liberal

Reset 1980-2008

Business Responded to Inflation by going global,

lowered wage growth and in the US, |

3. The Ugly Reactions to Neoliberalism 2008- Sustained Deflation

had Winners-Losers |

Structural Causes

|

|

|

Structural Causes 2008- Lack of Bank Regulation High Leverage Short-Term Commercial Bank Reserves Were in Euros When Dollar Reserves Were Required. Neoliberal Economist Under Estimated Economic Effects of Financial Market on Economic Activity. Government t Helped the Top and the Bottom Creating Middle Income Envy. |

|

| Economic Effects | |

| Winners | Losers |

|

Populist Nationalist Parties attracted voters with renationalization and anti-austerity policies. |

Center Left Parties

lost control as lower wages and fighting more over less, and cartel politics blamed capitalism and globalism. Center right parties in control blamed immigrants and globalism. |

|

Debtors Can't or Won't

Pay Deflation Kills Wage Growth Real Debt Value Increases |

Creditors lost as Real Value of Debt Up But Some Don't Pay |

|

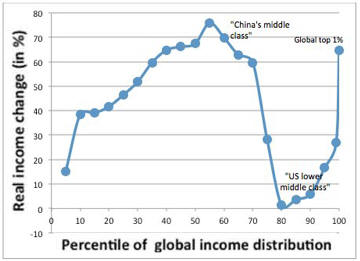

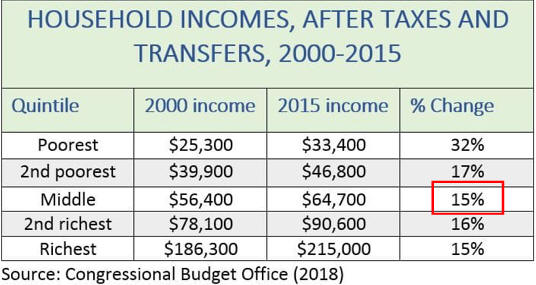

World's Very Poor and Very, Very Rich Won Middle Earners of Rich Western Nations income Stagnated. |

|

|

Bottom Line A Return on Capital Growth R > Growth rate of the Economy G.

90% of Income Gains

Went to Top 1% and since 2012,

Continued Expansion

of Credit aided by low interest rates, Trump

Could the

The_4G's of Politics, not economic inequality, |

|

Mark Blyth Summarizes 30 Years of Western Capitalism

Editor: True: Capitalism did what it was suppose to do and

protected profit from foreign competition.

Union leaders protected their jobs with tow tire wage contrects.

Science and debt did much to improve wellbeing.

Politicians, median and economists avoided change to stay in office.

A Worldwide Threat Assessment From GZERO media

As we noted in the Wednesday edition, the US intelligence community

has released its latest Worldwide Threat Assessment.

Much of the media focus this week has fallen on

President Trumpís criticism of the US intel chiefs,

but letís begin with the report itself. Here are its key findings:

The Trump administrationís trade policies have damaged US interests

by pushing allies to build new relationships with other governments.

ďAt present, China and Russia pose the greatest espionage and cyber attack threats.Ē

ISIS isnít finished.

Climate hazards

threatening infrastructure, health, and water and food security.Ē

North Korea

ďis unlikely to completely give up its nuclear weapons and production capability.Ē

North Korea has continued nuclear development in some areas

and taken actions that are reversible in others.

Iran continues to support terrorist groups in the Middle East and Europe,

but itís still complying with the terms of the nuclear

|

See

Mark Blyth explains

Crashed Video and

book-review of Crashed:

|