#5

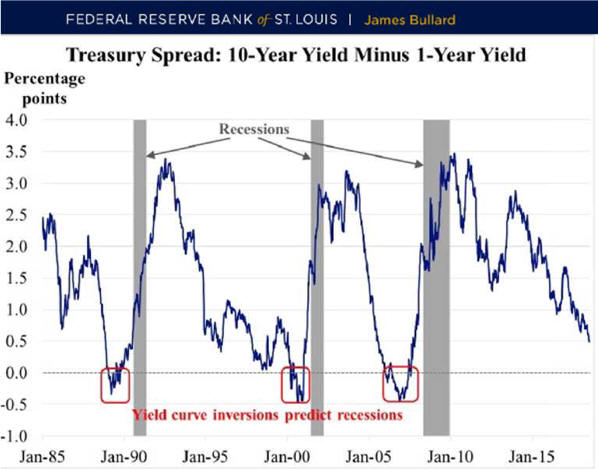

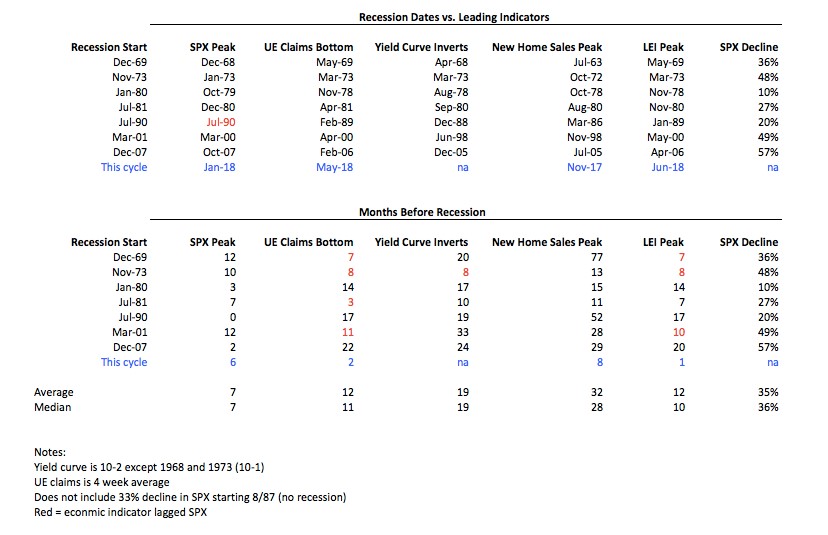

U.S. Headed for a Recession?

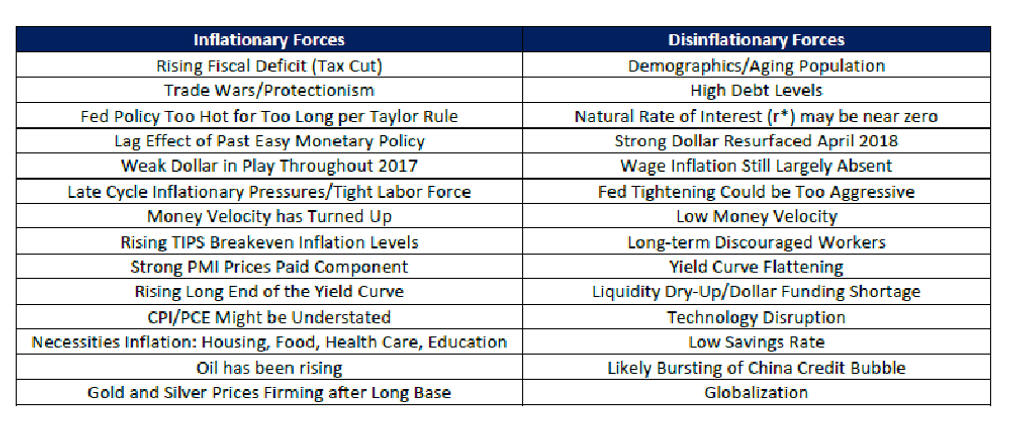

Late in Cycle is About Liquidity

Current Data

Weaker Counter Cyclical Measures

Predictions

Recession

Investment Alternatives

Return to Latest Economic News Updated 12/21/19 Please link to, use to educate and share.

Return to Latest Economic News Updated 12/21/19 Please link to, use to educate and share.

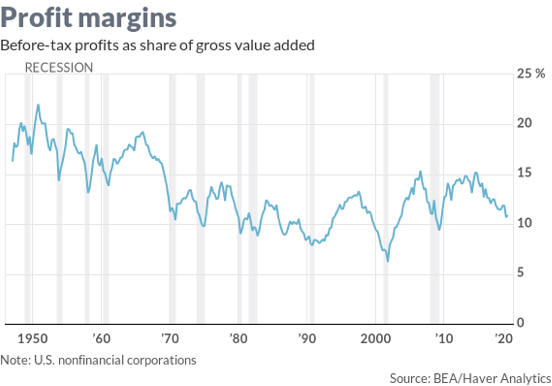

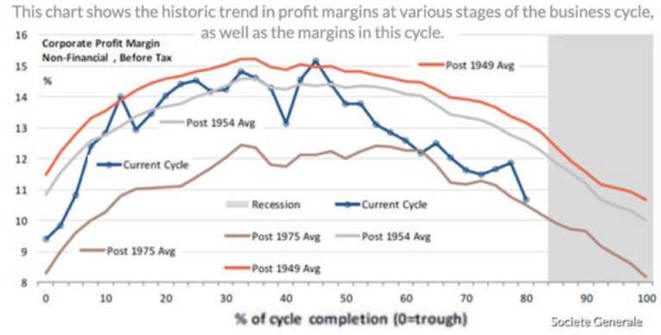

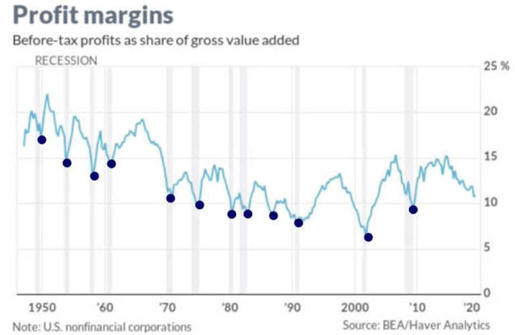

Profit Margins Headed South

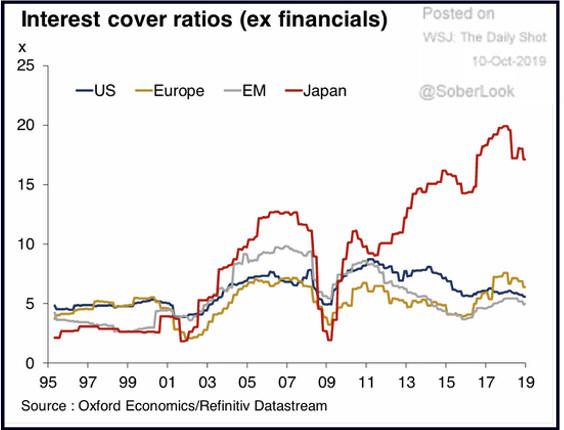

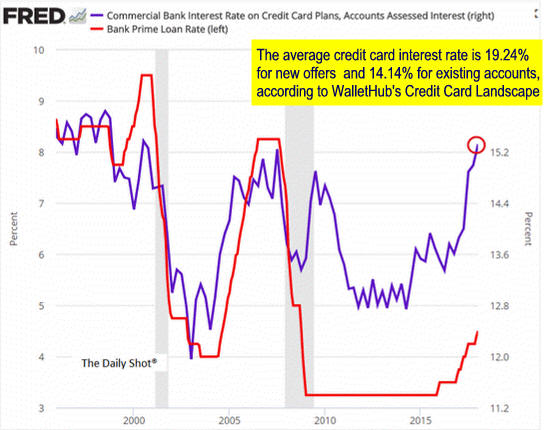

Increased Interest Rates Will Hurt Profit

and Consumers as Demand Will be Affected

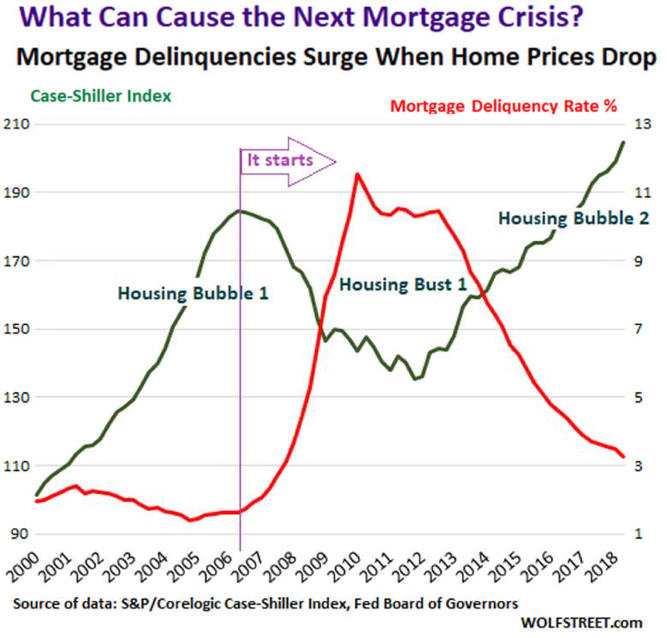

So Will Mortgage

Refinancing

Source

wolfstreet.com/

Auto Sales Already Affected

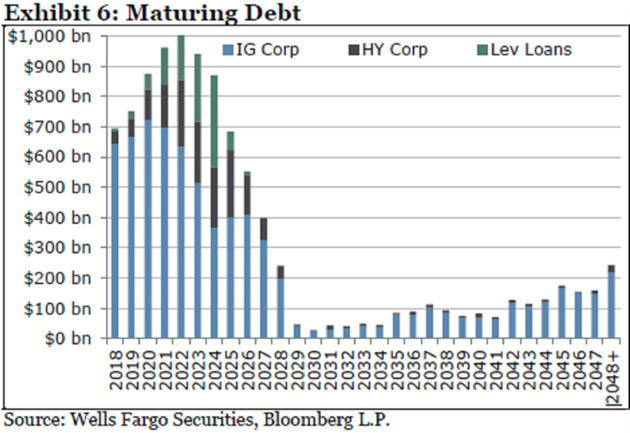

Increased Refinancing Needs Will Affect Profit

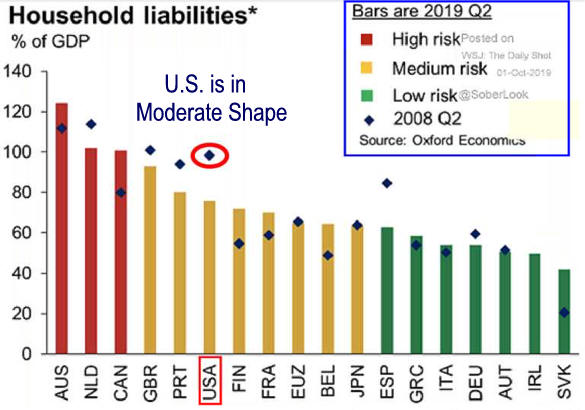

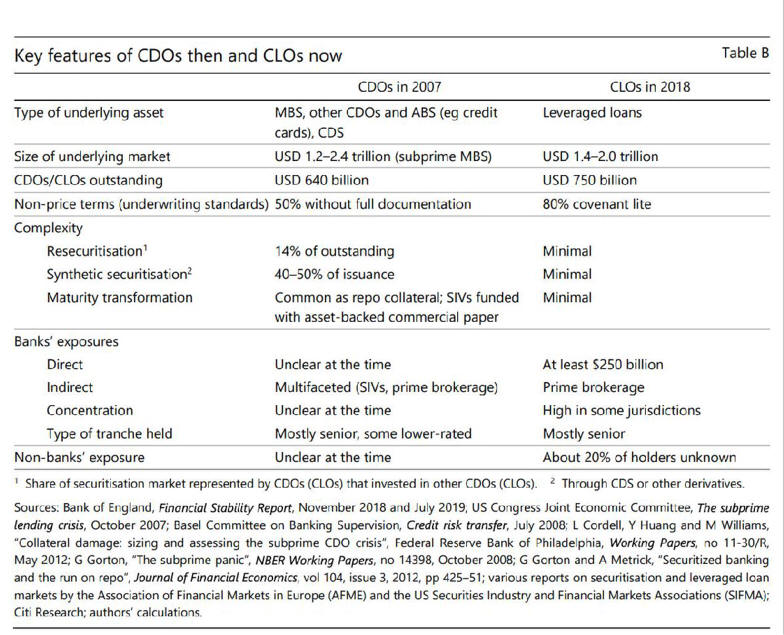

Vulnerability to Recession

U.S Consumers Returned to Trend

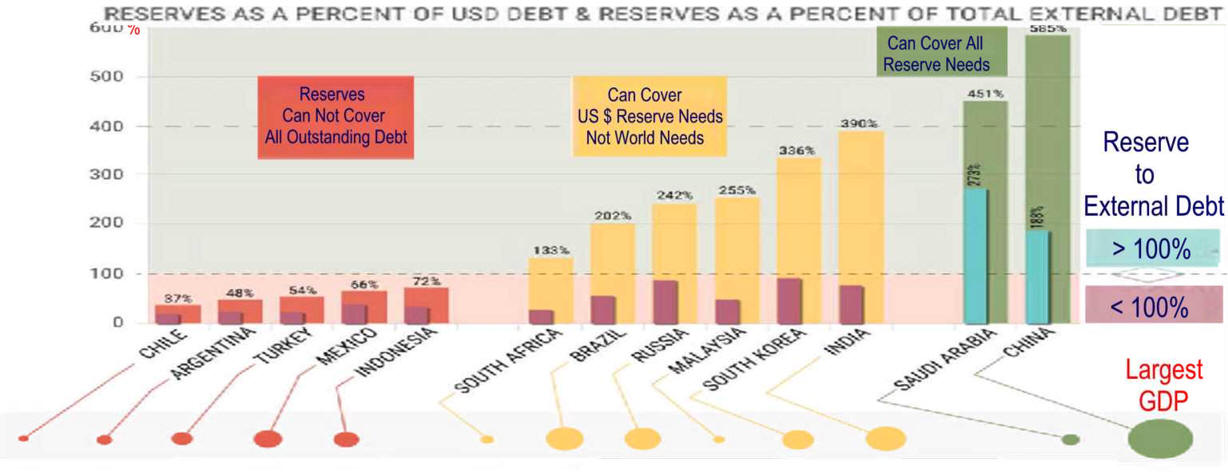

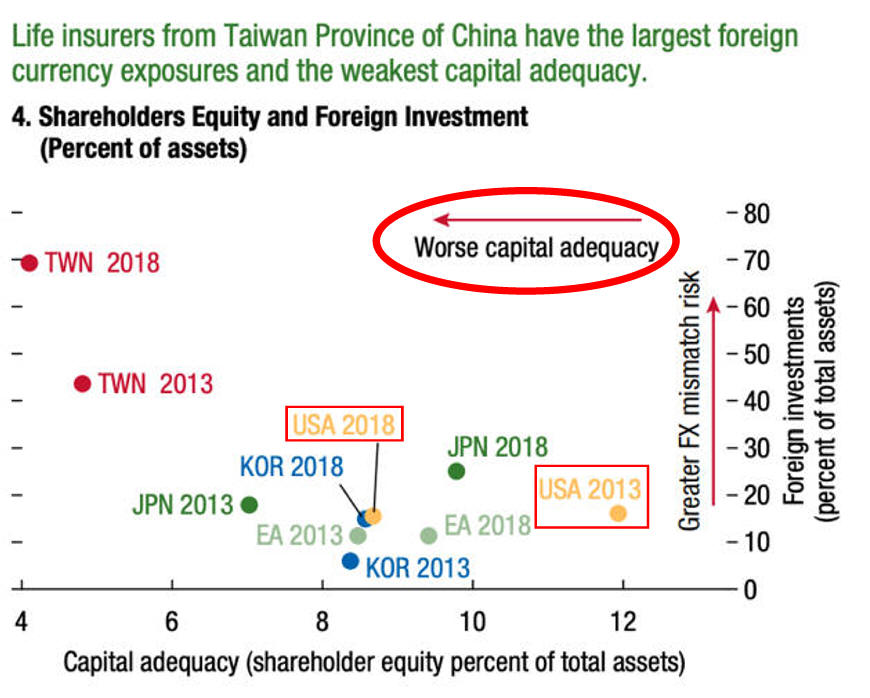

Most Developing Countries Vulnerable

The Emerging Market Crisis is Back. and This Time it's Serious Global Output Growth is Little Changed in First Quarter

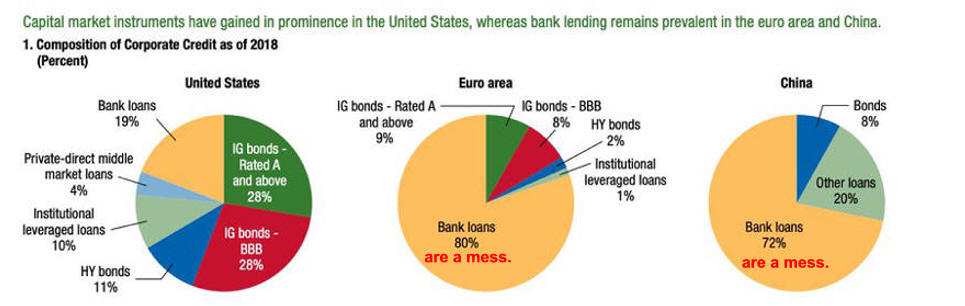

US Companies Move from Bank Loans Into High Risk Specialty Credit and

Out of Equity Capital

Recession Hurts Workers

This Key Counter Cyclical Measure is Very Weaker

"

"