|

Entitlements Basics |

||||

| Summary | Definition |

Who Benefits from Most to Least |

Problems |

Concerns |

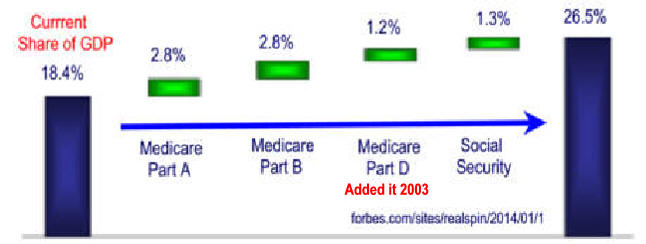

| Medicare |

Subsidized healthcare for the elderly |

All benefit are the same,

high income earners pay most |

Required additional

|

Longer life, especially for poor people who now also have subsidized health care, will increases cost. Free cases poorer health. Solutions, later eligibility, less coverage, higher deductibles currently not acceptable to electorate. |

|

Social Security |

Retirement income, partial at 62, full at 67 and max at 70, |

Low income earners receive

a higher investment return, some receive death and spousal benefits |

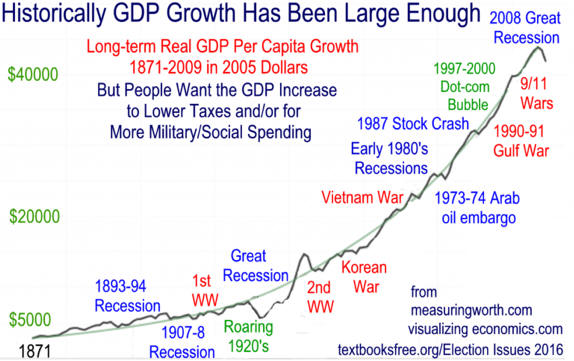

Deficit concerns until baby boomers die, retirement age raised or young people vote.SS Benefits are 100% Secure, but their real value depends on economic success.. | Solution just time or later retirement but politicians will not act until forced by electorate Increased negative cash flow should add political pressure. |

|

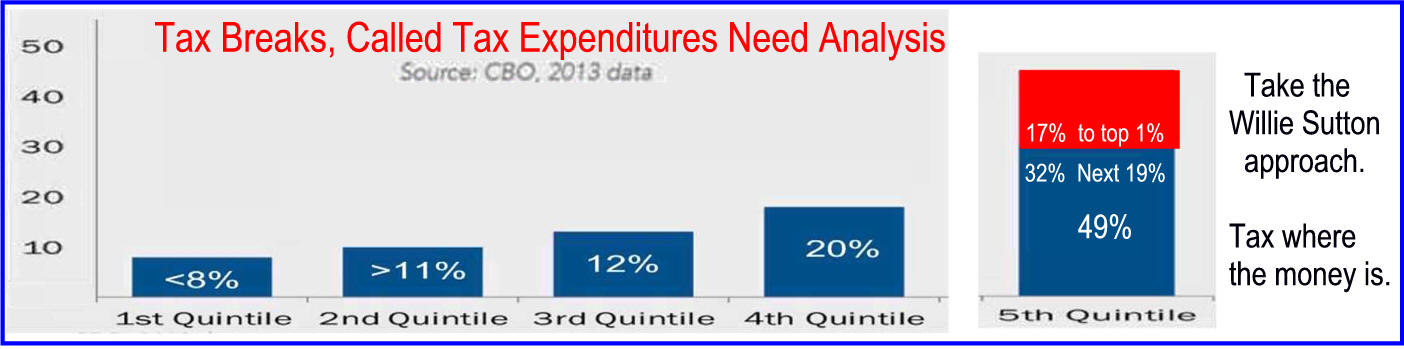

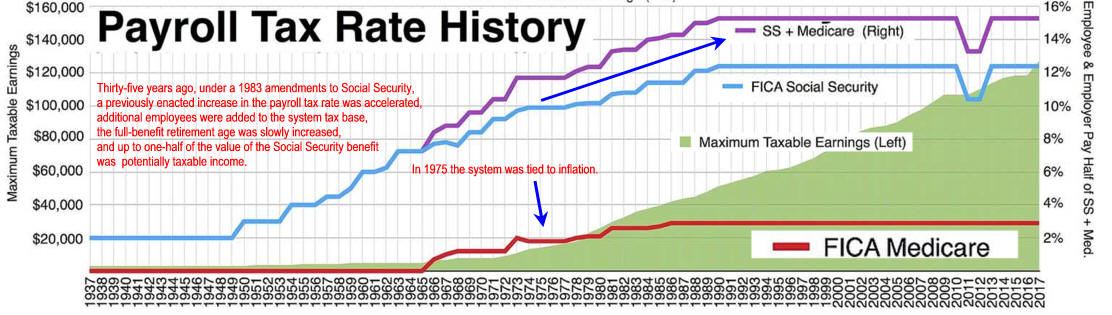

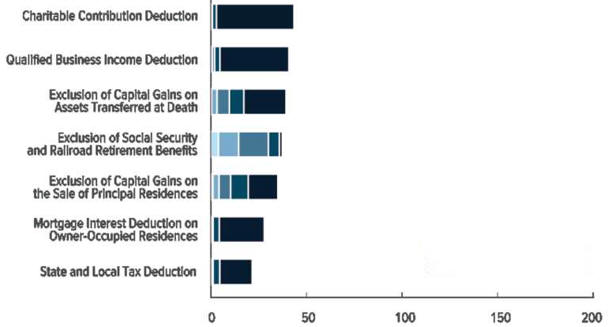

Tax Expenditures |

Legal deductions and exemptions from income decrease tax collections | Employee sponsored health insurance,401K, long-term capital imputed rental income, mortgage interest, earned income tax credits, deferred income from controlled foreign corporations Table 2 |

Tax payers don't

appreciate

|

Solution of decreasing them by a third is unacceptable to electorate though this would have increase tax collections $400 billion in 2015 when the deficit was $439 billion. |

|

|

||||

Tax Expenditure Amounts (billions)

|

cut

|

|

|

49% go to top income quintile